Welcome to Malaysians on Malaysia: our quarterly report on Malaysian consumer confidence. This round in Q2’21, we see Malaysia in FMCO (Full Movement Control Order), otherwise known as MCO 3.0 – the third round of lockdowns the country has seen. Read on to see essential insights into confidence, behaviour, our COVID-19 response, e-wallet, tech and esports trends in Malaysia.

As we continue to brave through the COVID-19 pandemic as a nation, our Malaysians on Malaysia study gives us a glimpse of the trends and sentiments during this period – this time focusing on how consumer confidence in FMCO records a sharp dip. Our previous coverage on Malaysian consumer confidence for 1Q 2020 can be found here.

Malaysia in FMCO and COVID-19 Vaccination Picking Up Pace

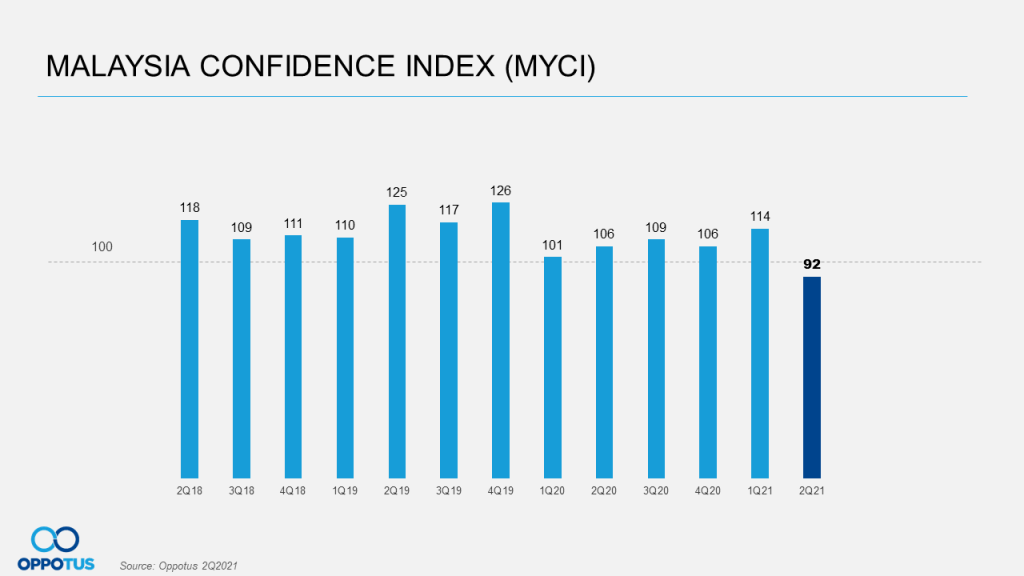

With the implementation of FMCO, our MYCI index saw declines to record an all-time low of 92 points. The current lockdown is having a significantly negative impact on Malaysians in general, and it is felt across all segments of the population. Sentiments are depressed currently with the lockdown having no end in sight.

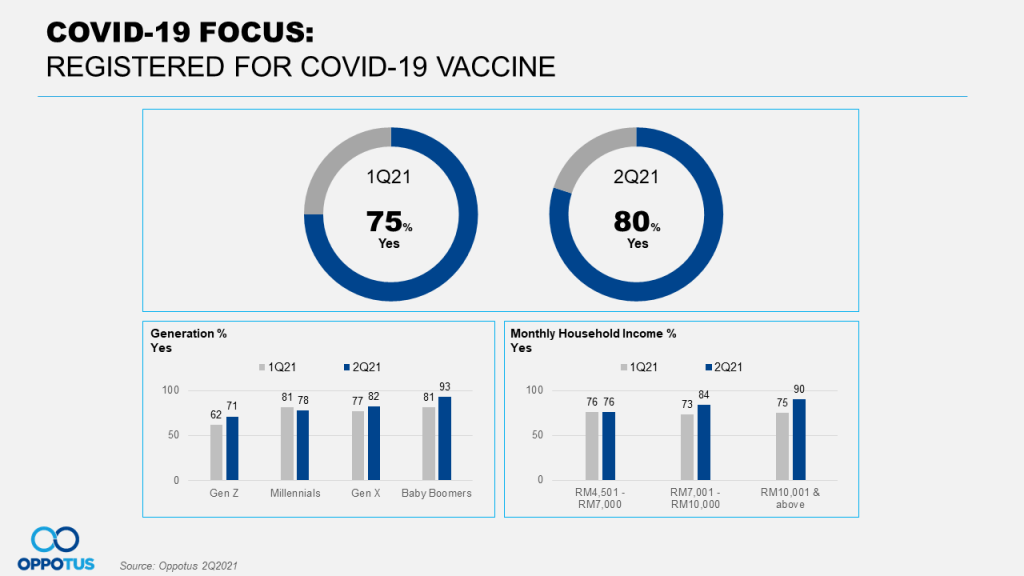

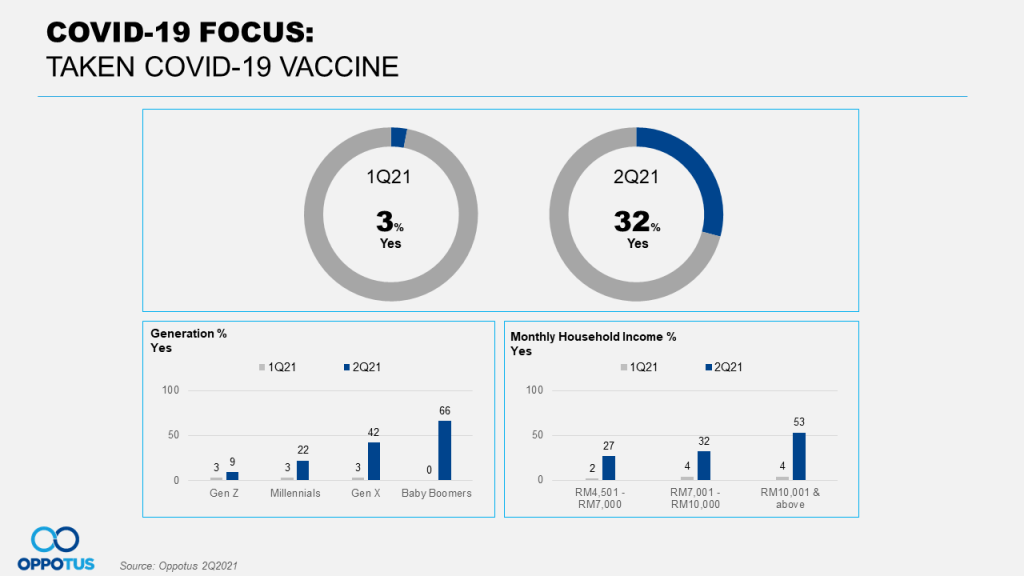

Despite concerns around the various COVID-19 vaccines, 95% of Malaysians claim that they still want to take the vaccine, and 80% of adult population now claim they have registered for the vaccine. 32% have taken at least one dose of the vaccine – a marked improvement to the last time we measured this back in Q1 of 2021.

Optimism to Financial Well-Being Dampening

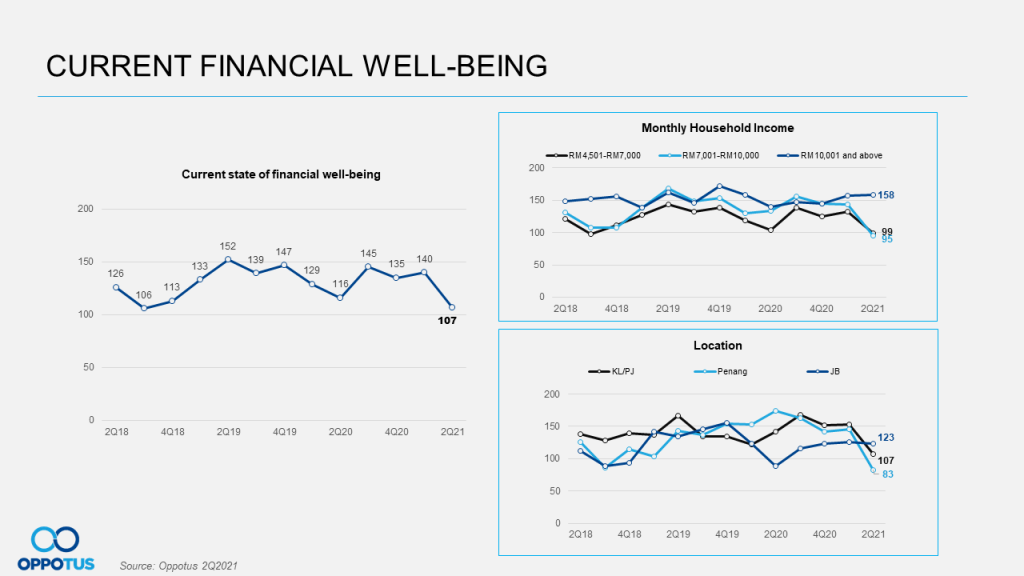

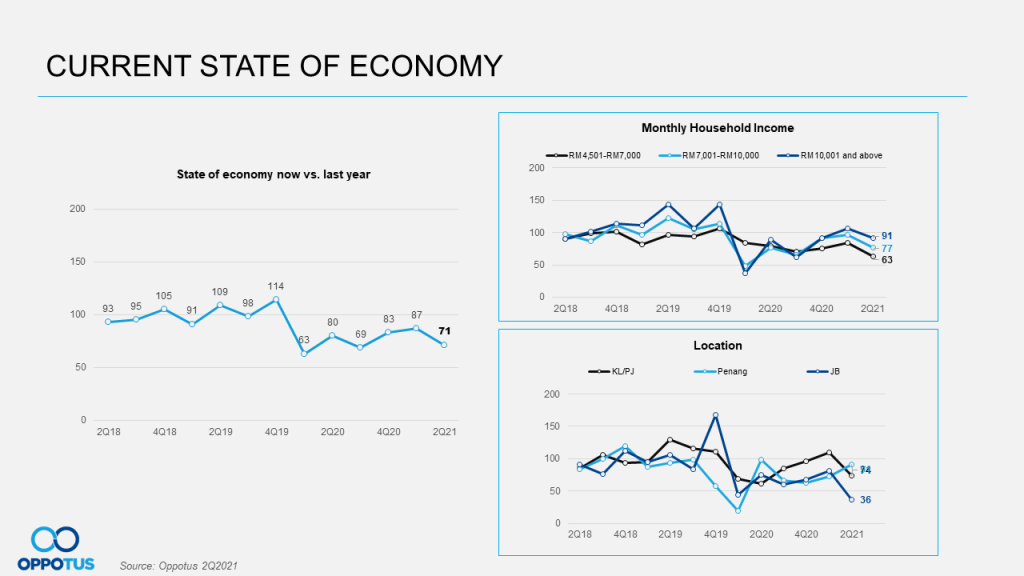

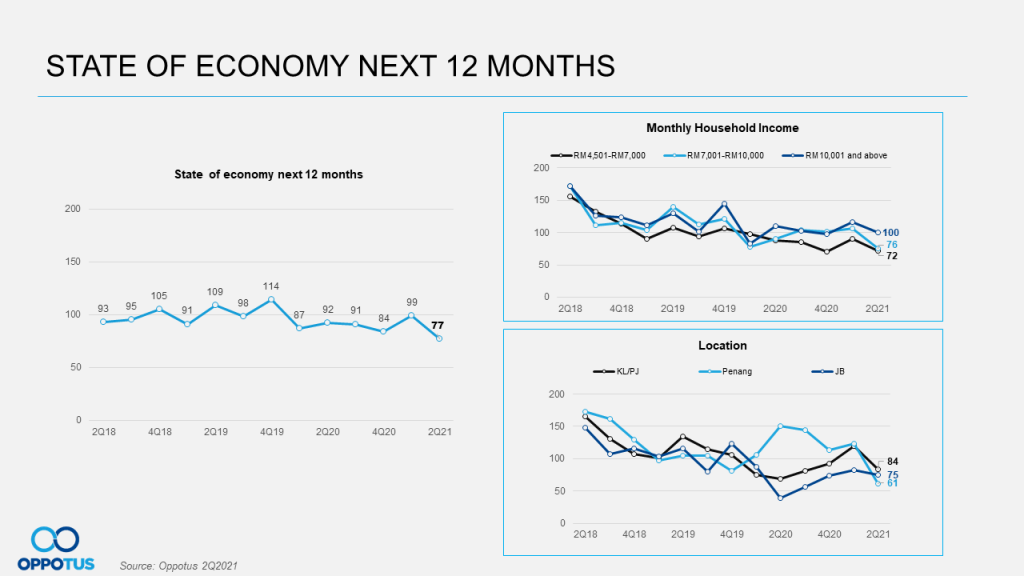

Our economy indices were showing an uptrend over the past 2 quarters. Just when there is a sliver of hope of recovery on the country’s economy, our indices shows contraction with the onset of Malaysia in FMCO. News about the availability of COVID-19 vaccine in Malaysia did little to boost Malaysians’ sentiments, outlook and confidence this time round.

News coverage on recessions, major investors potentially pulling-out from Malaysia, economic downturn, etc. were frequently reported this quarter, which has further contribute to the decline in overall consumer confidence. These events and uncertainties around us are affecting the well-being of Malaysians directly too. With work and businesses closing or slowing down, it has had a negative effect on optimism of Malaysians perceptions of their financial stability as well.

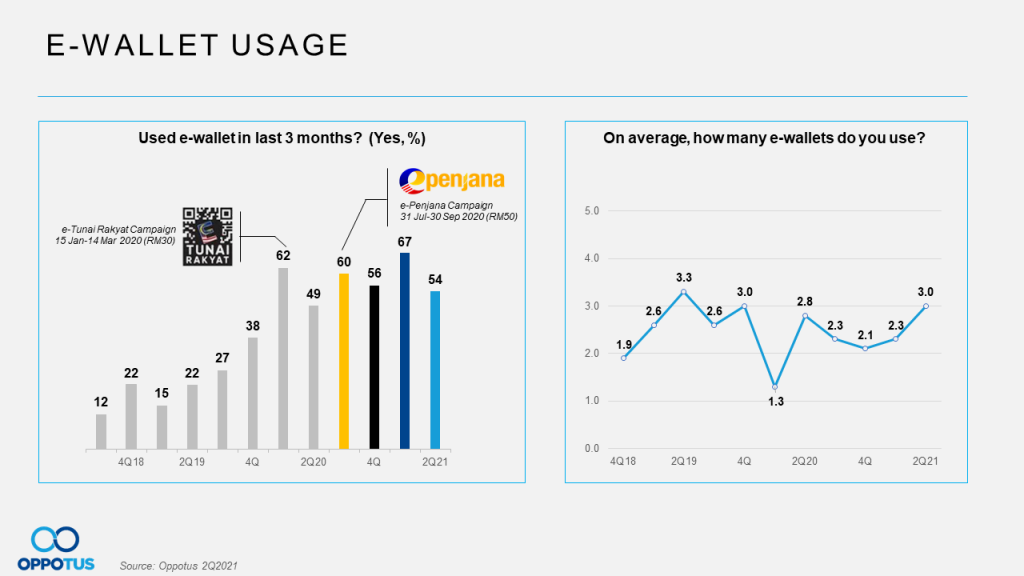

Usage of E-wallet Decreases

Frequency of Malaysians using e-wallet declines during this period. With Malaysia in FMCO, and many of the workforce working from home and many business not being allowed to open, it has resulted in a reduction of the number of places where people can spend.

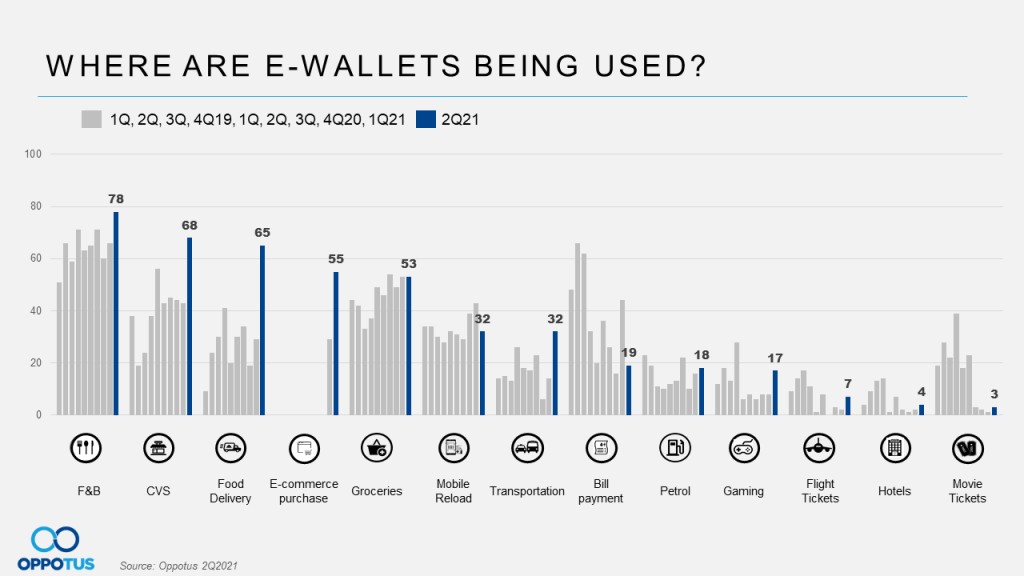

Having said that, e-wallets usage towards in the F&B, Convenience Stores, Food Delivery, E-Commerce, and Groceries channels remain high – and in some cases usage rates here are highest it has ever been.

People are in general using more e-wallet brands now, with most owning and using an average of 3 different e-wallets, which is an increase from before. It appears that the availability of different promos or services offered by the different players is a motivator. Malaysians’ E-wallet users are mainly the young adults (25-34 years old), PMEBs and upper M40-T20 group.

If you like to dig deeper into the numbers, please do reach out to us on theteam@oppotus.com

It’s the second quarter of 2021, and Malaysia goes into another round of lockdown again. During this FMCO, majority of the businesses have not been allowed to operate except for businesses in the essential services once again.

At 92-points, our Malaysian Confidence Index (MYCI) is at an all-time low.

Although it is not the first time Malaysia is experiencing a lockdown, the repeated fashion in which the country has been placed into and taken out of lockdowns is having a significant negative impact on Malaysians on the whole. And this sentiment cuts across large masses of the Malaysian population.

With most businesses not able to operate during this period, Malaysians are getting worried about their personal financial well-being, reflected in index dropping to one of the lowest levels at 107-points.

Similar contraction is also seen across various income groups and locations. Having said that, the T20 segment continues to remain optimistic about their current financial well-being.

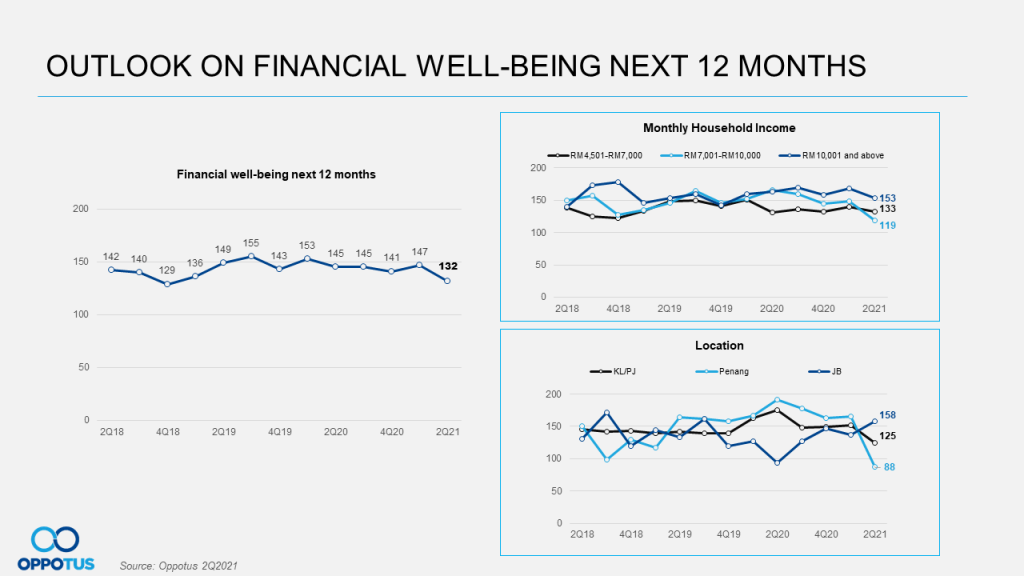

In all, the current conditions does affect sentiments when looking forwards to their financial well-being in the near future too, but is not as drastic as current indicators – suggesting that Malaysians are more optimistic for themselves for the future even though currently they are less so.

This dip is registering stronger among the upper M40 segments more so.

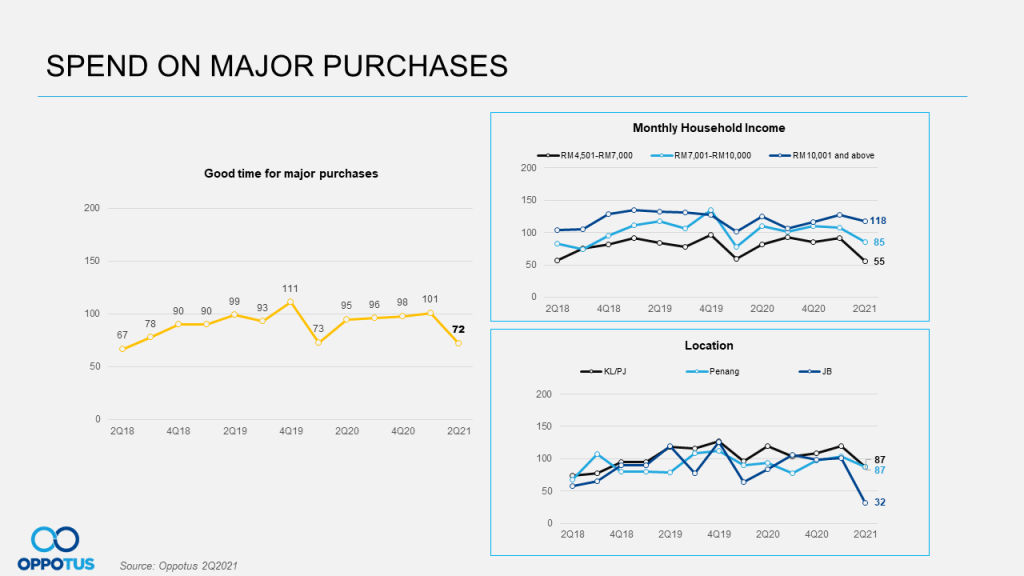

Despite the index being on a recovery trajectory over the previous quarters, we see a sharp dip this quarter for spend on major purchases, wiping what gains we’ve had. The index has now fallen below the 100-point mark again, signaling Malaysians are once again on-the-whole more cautious with using of money.

In line with the dampened sentiments of Malaysians worrying about their financial well-being now, it is definitely not a good time to be spending in a major way (this correlation is very similar to what we saw during MCO1.0 too) – and this is very pronounced across the board.

Malaysians’ positive vibes towards the availability of COVID-19 vaccine in 1Q21 did not sustain. With Malaysia in FMCO, people’s sentiments towards the current state of country’s economy dropped to 71-points. The index has stayed below the 100-pt mark for the last 18-months, showing an extended dampened confidence towards to current state of the Malaysian economy.

Likewise, indicators for the Malaysian economy in the next 12 months continue to see contraction as well, and similarly has remained low for the last 18 months too. Malaysians are expecting that recovery of our economy would take longer than expected.

FOCUS: COVID-19 and Its Impact on Malaysia

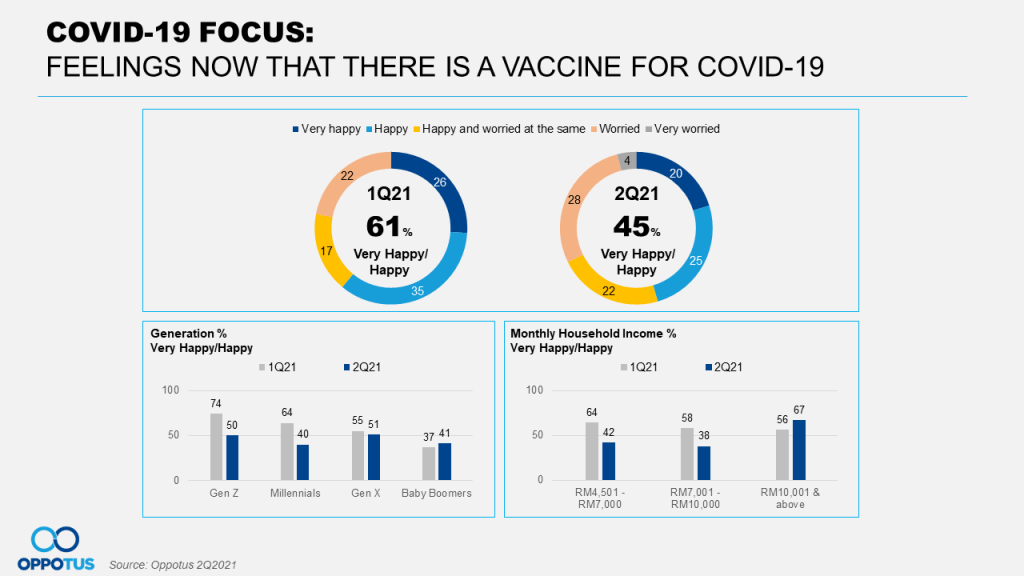

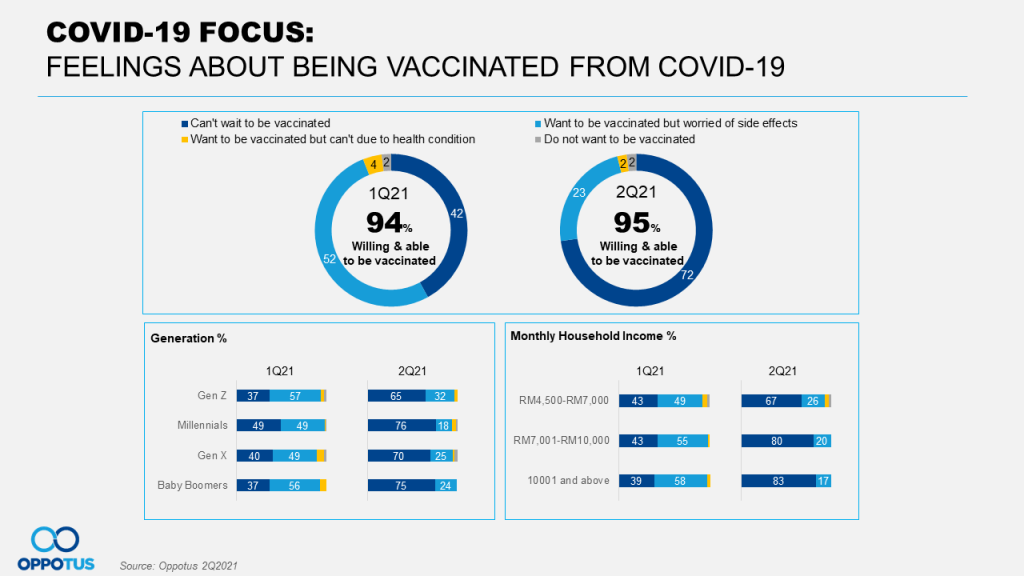

Coverages around the pro and cons of the different COVID-19 vaccines are all over the social media. With that, Malaysians are showing more signs of concerns towards the various vaccines available. Hence, the rate of Malaysians worry to get vaccinated went up slightly from 22% in 1Q21 to 32% 2Q21, mainly amongst the Gen Z and Millennials.

It could be possibly due to various news or hearsay alleging the potential side-effects of the vaccine. At the same time, concerns about the vaccines are also higher among the M40 groups.

Despite the mixed reactions towards the COVID-19 vaccine, 95% of Malaysians are still keen to be vaccinated. 72% of Malaysians claiming that they “can’t wait to be vaccinated”, which is almost double of the 42% rate in Q1’2021.

However, there are still people who has hesitant about the vaccines and concern about the side effects. And again, it is more prominent among the Gen Z.

With the increasing confirmed cases of COVID-19, Malaysians are eager to get vaccinated. 80% of Malaysians are claim that they have already registered for the vaccine. For this reason, vaccination registration rates continues to grow among the Baby Boomers, Upper M40 and T20. And, the registrations are also picking up among the Gen Z now.

During Q2, Malaysia has been slowly ramping and speeding up the vaccination process. Our data now show that 32% of Malaysians claim that they have already been vaccinated (with at least the first dose) vs. only 3% in Q1’2021. The vaccination rates has gone up rapidly across all groups, especially among the Baby Boomers, Gen X and the T20 income group.

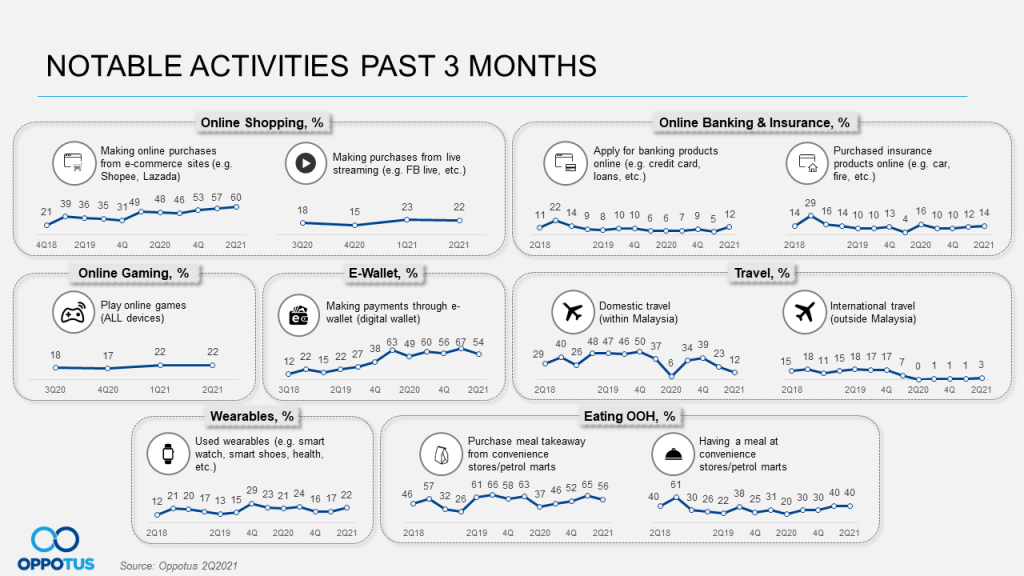

With movement restrictions order, Online Shopping has become increasingly popular in Malaysia. However, the rate of making payments through e-wallet falls as Malaysians worry about their financial well-being.

Without a doubt, the number of domestic and international travel remains low as inter-State travel is not allowed.

As the country goes into FMCO (MCO3.0) in June 2021, nearly 80% of the working population found themselves needing to work from home once more. With movement restrictions in place, usage of e-wallet sees a decline. The nature of e-wallet which is mainly for making payments for in-store purchases. Therefore, the decline in usage of e-wallet is not surprising considering consumers are not out during this period.

Despite a decline in usage, Malaysians are seen to be using an average of 3 different e-wallets this time around. It could be due to the different services/promotions offered by the different players.

Averagely, Malaysians spend close to RM400 per month through e-wallets.

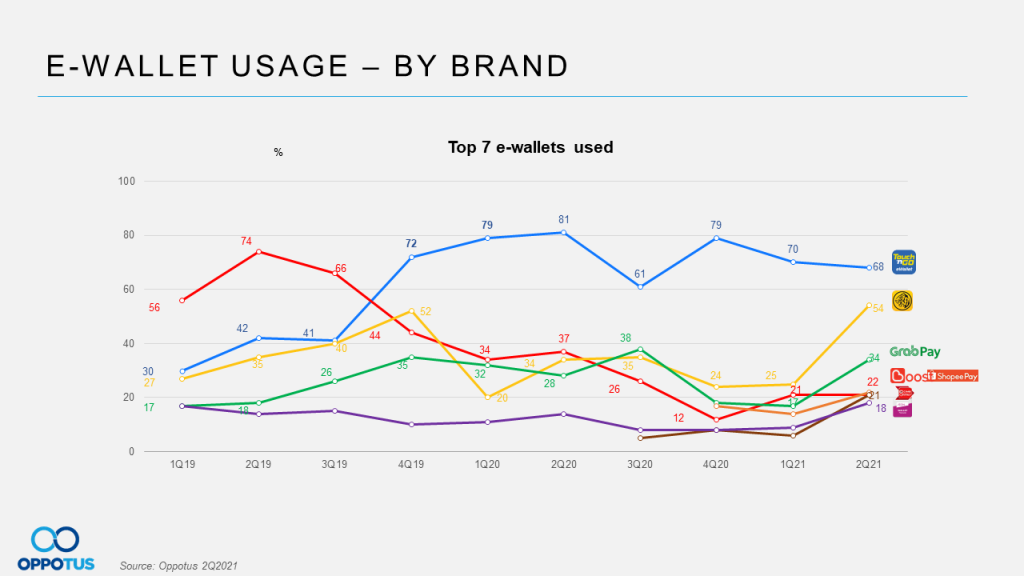

Although still the clear market leader, Touch ‘n Go e-wallet’s usage seen to be on a slight decline since Q1’2021. While usage of Maybank QR Pay (in particularly), Grab Pay, CIMB QR and AEON Wallet saw increases in Q2’2021.

CIMB QRPay is making a prominent mark too. It is garnering a respectable usage rate in the e-wallet payments category since having just launched fairly recently in Q3’2020.

The usage of e-wallets increases across the different channels, especially during lockdown and movement restrictions order. Malaysians spend more on F&B outlets and Food delivery as dine-ins not allowed at restaurants.

Besides that, groceries and other essential items need to be restock frequently as people advised to stay at home. Hence, the spending on Convenience Stores (CVS), E-commerce Purchase and Groceries increases as well.

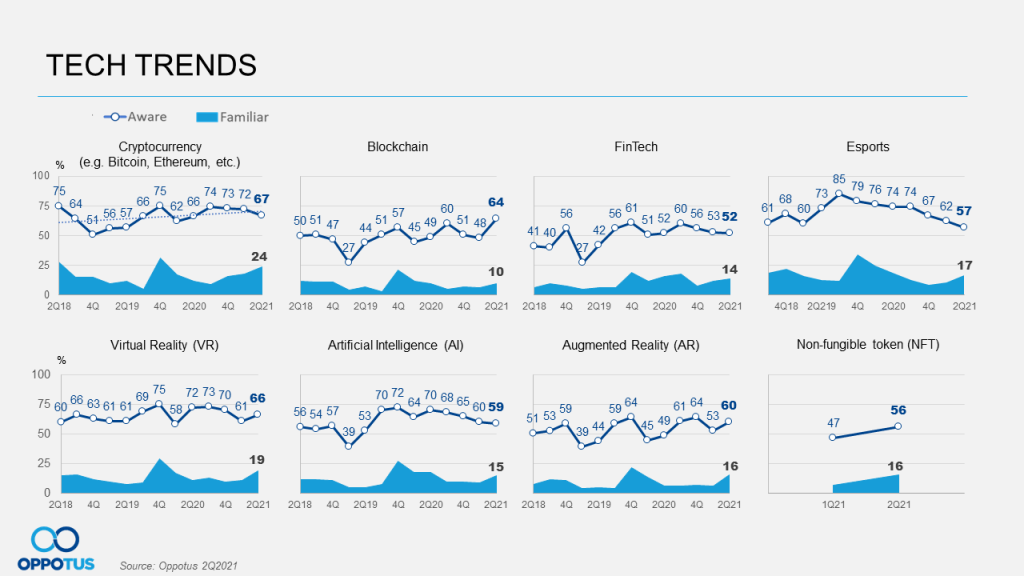

In order to prevent the spread of COVID-19, people are working remotely, shopping online, having online classes, and etc. With all these digital transformation during pandemic, people have no choice but heavily rely on technologies. During Blockchain’s previous peak (60%) in 3Q20, the current awareness of Blockchain has hit its highest at 64%.

While the awareness for Cryptocurrency, FinTech, Esports, and Artificial Intelligence (AI) are dropping gradually since 3Q20. Conversely, Virtual Reality (VR), Augmented Reality (AR), and Non-Fungible Token (NFT)’s awareness have improve compared to the previous quarter.

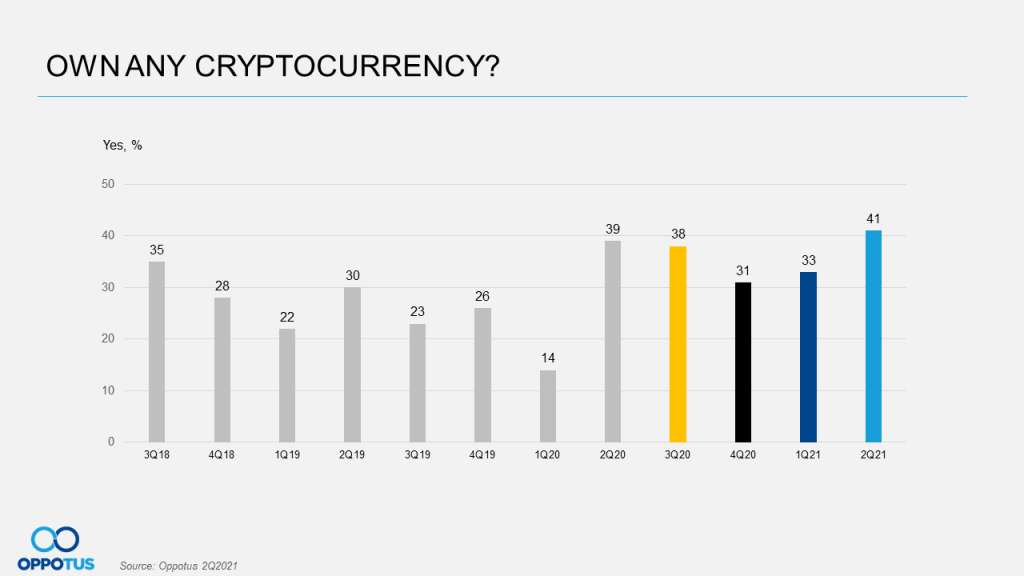

How close are we to a cashless society? With Cryptocurrency being in the limelight recently spark interest towards the various ‘coins’, Malaysians are becoming more familiar with digital currency. The current ownership rate of 41% has surpassed the previous peak (39% in 2Q20) after a year. It is by far the highest rate seen since 2018.

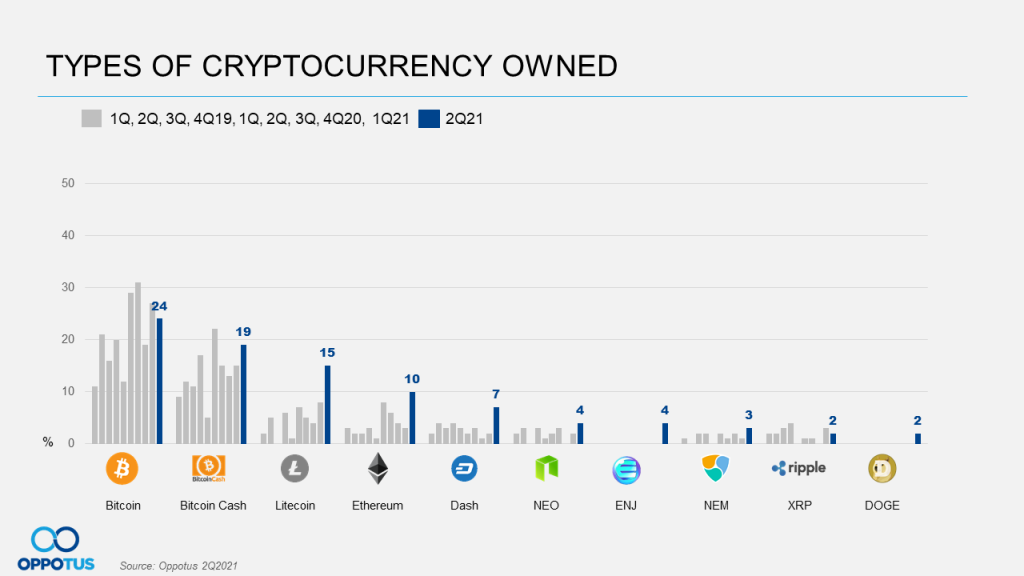

Without a doubt, people’s interest towards Bitcoin (BTC) remain highest among other type of cryptocurrencies. However, the interest towards other coins increases at the same time too; particularly for Bitcoin Cash (BCH), Litecoin (LTC) and Ethereum (ETH). With interest gaining with Enjin Coin (ENJ) and Dogecoin (DOGE), Malaysians’ interest towards these coins will be measured from this quarter onwards.

Malaysians on Malaysia cover opinions of Malaysians aged 18 and above, M40 and T20 segments, in key cities of Peninsula Malaysia representatively.

For a closer look at the data, feel free to contact us at theteam@oppotus.com.

(Featured Image Source: Lipstiq)