Welcome to Malaysians on E-Sports Q4, a look into the state of e-sports in Malaysia, featuring the trends and potential of the industry.

With the Malaysian government recently allocating a budget of RM10 million to the Malaysia Digital Economy Corporation (MDEC) for the development of e-sports programs across the country, the Malaysian e-sports industry looks set to grow faster than ever in 2019. Several tournaments are already established, and national leagues are in the pipeline that would be rolled out in 2019. The ministry has also placed emphasis on supporting e-sports athletes and eventually building a thriving ecosystem.

In Q4, we have continued our research into the e-sports trend and behavioral progress among Malaysians, and our data shows that e-sports is now well received at all study locations. This is understandable given that there are more e-sports events held nationwide, which have enjoyed increased awareness and participation. At the moment, many companies are having difficulty finding ways to effectively engage with millennials, but our studies show that e-sports provides an interesting and increasingly effective way of engaging with the millennial demographic which not many brands are taking full advantage of at the moment.

Within this study, we took a closer look into the level of awareness of e-sports, trend progress, and it’s impact on brands, providing you with insight into the e-sports market and how it can benefit your brand.

The Study

The e-sports ecosystem is comprised of various components and actors, all of whom play different roles which are essential to the function of the ecosystem as a whole.

Teams: Professional e-sports players and the organisations that manage them.

Publishers: The companies which develop and/or publish the games that are played in e-sports.

Events: Physical events where e-sports related activities take place. E-Sports events take place on multiple scales, from large dedicated e-sports conventions to smaller scale e-sports activities taking place as part of a larger event.

Brands/advertisers: Brands which use e-sports as a marketing platform, taking advantage of the reach and audience of e-sports to reach the youth/gaming demographic. This isn’t necessarily limited to native brands in the e-sports industry. Several notable international brands such as Hyundai, Gillette and Mercedes-Benz have already made considerable investments into e-sports, and we expect to see more and more mainstream brands enter the e-sports sphere as the industry continues to grow internationally and more brands begin to see the potential of e-sports as a tool for engaging with the millennial demographic.

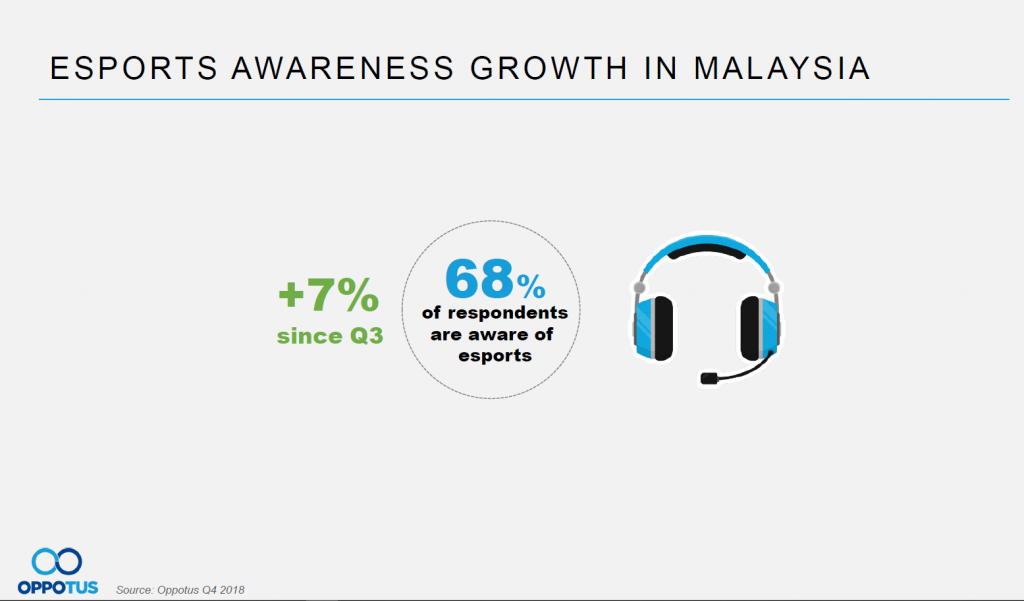

The e-sports scene in Malaysia has garnered nationwide attention since the amplification of e-sports initiatives being made by the new government and other independent organisations such as Razer which have all garnered significant media attention.

This number is expected to rise throughout the year as more large scale e-sports events are held throughout Malaysia which will continue to expose e-sports to the general public, along with the upcoming SEA games which will feature e-sports as a medal event for the very first time.

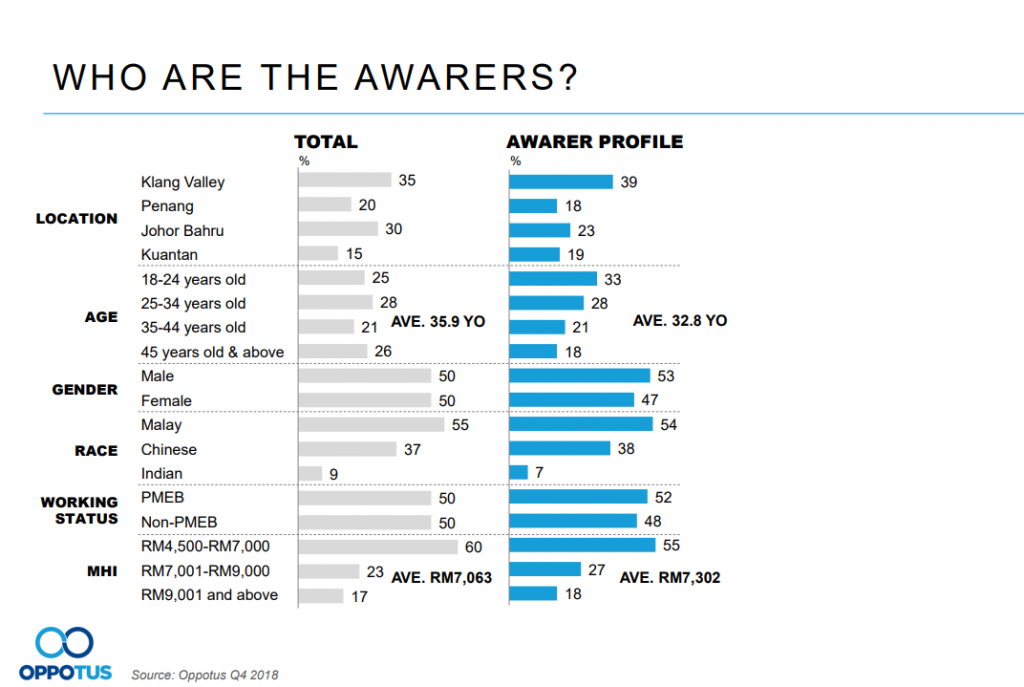

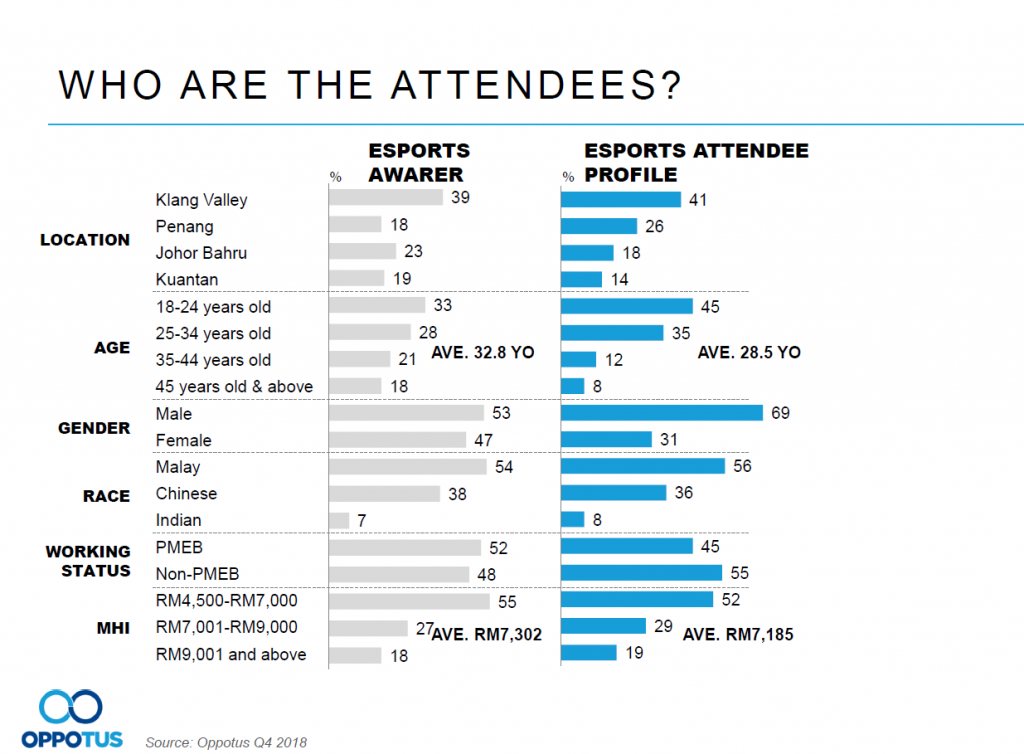

In our profiling of Malaysians who are aware of e-sports, we found that the profile is generally skewed towards younger (18-24 year old) individuals living in the Klang Valley and, to a larger extent vs total, Kuantan.

Both males and females are equally aware of e-sports, suggesting that e-sports might have mainstream appeal amongst both genders nowadays despite gaming being viewed as a male-dominated activity in the past.

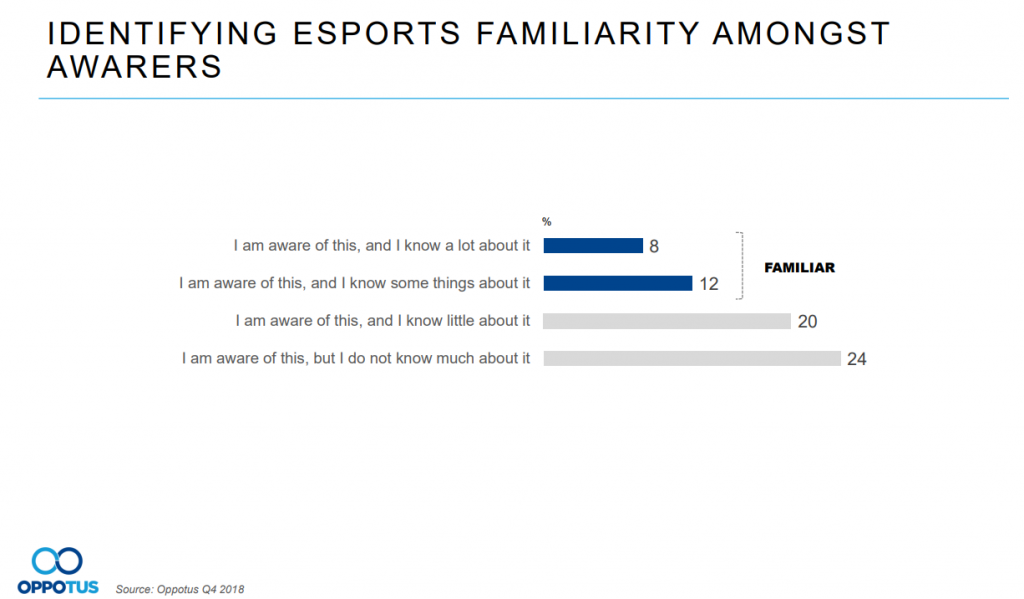

Furthermore, 20% of the people who are aware of e-sports also claims to know quite a bit about what it is. This 20% that are familiar with e-sports accounts for over 2 million Malaysians and are the group that we refer to as “e-sports familiars”.

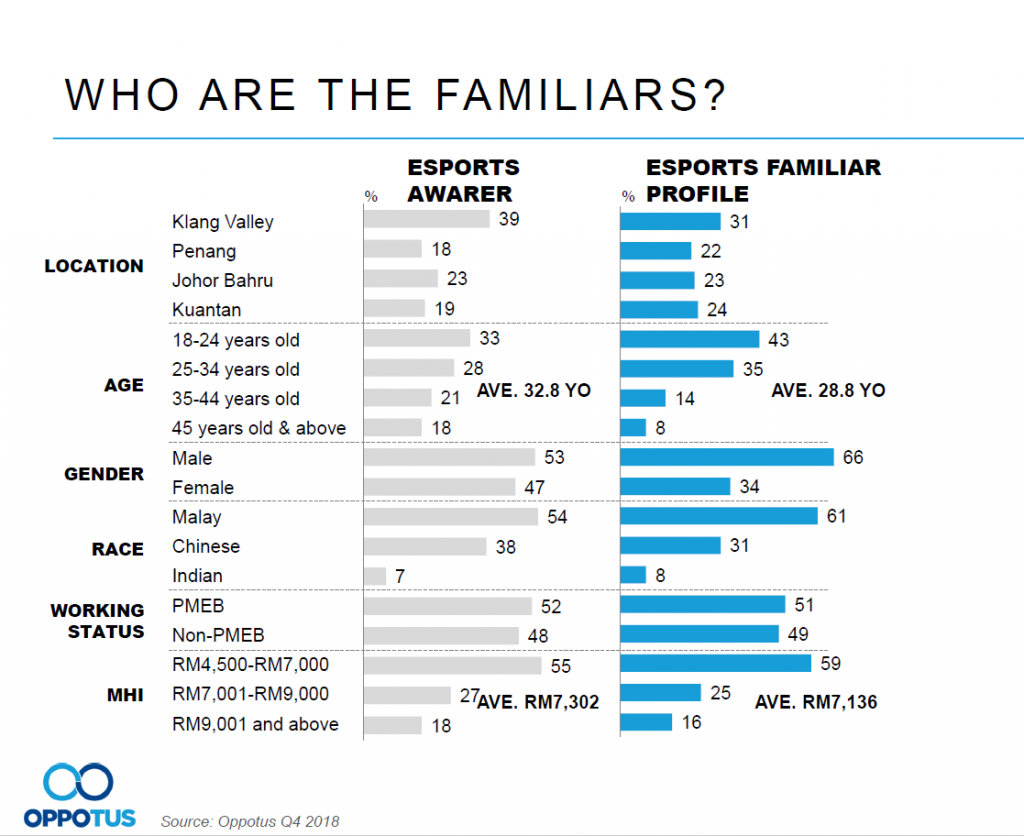

When taking a closer look at the profile of e-sports familiars, we see that it is skewed even further towards 18-24 year old’s when compared to those who are only aware of e-sports. E-Sports familiars also tend to be Malay males. This further reinforces the idea that e-sports is one of the best ways to reach and engage a significant portion of the 18-24 demographic – currently standing at approximately 2 million based on our latest count. Based on our observed trends, this group is likely to undergo steady growth as time passes and e-sports continues to increase in popularity. This also suggests that e-sports will become an increasingly significant way of engaging the millennial demographic on both a local and international scale.

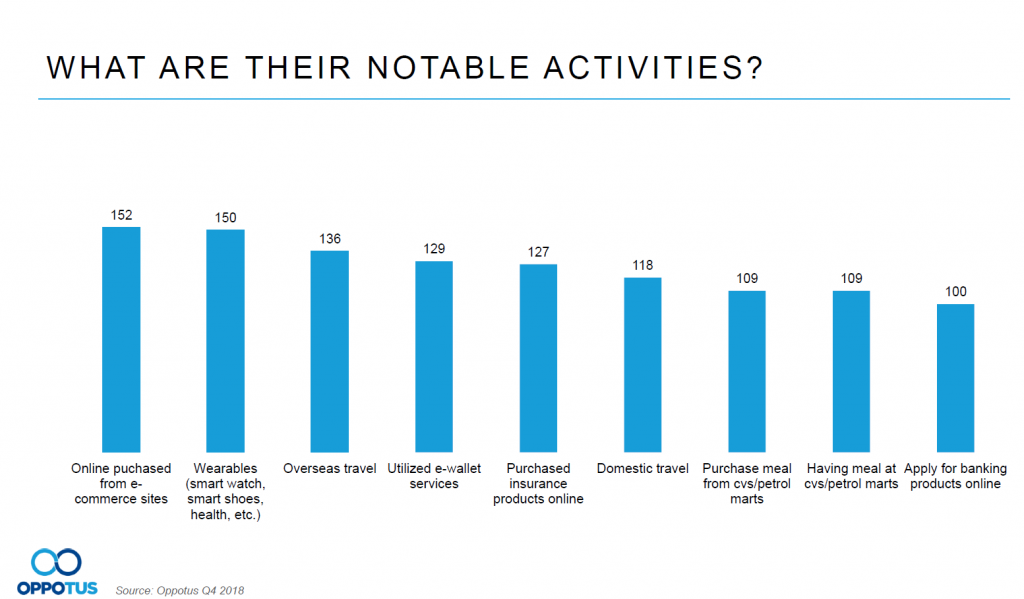

In this quarter, e-sports familiars are over indexed on online shopping, gadgets, overseas travel, and e-wallet usage. Although these verticals don’t normally cross paths with the gaming world, it now makes sense for industry players to get involved with e-sports at this point in time, since it presents a prime opportunity to reach and engage with potential consumers of the above.

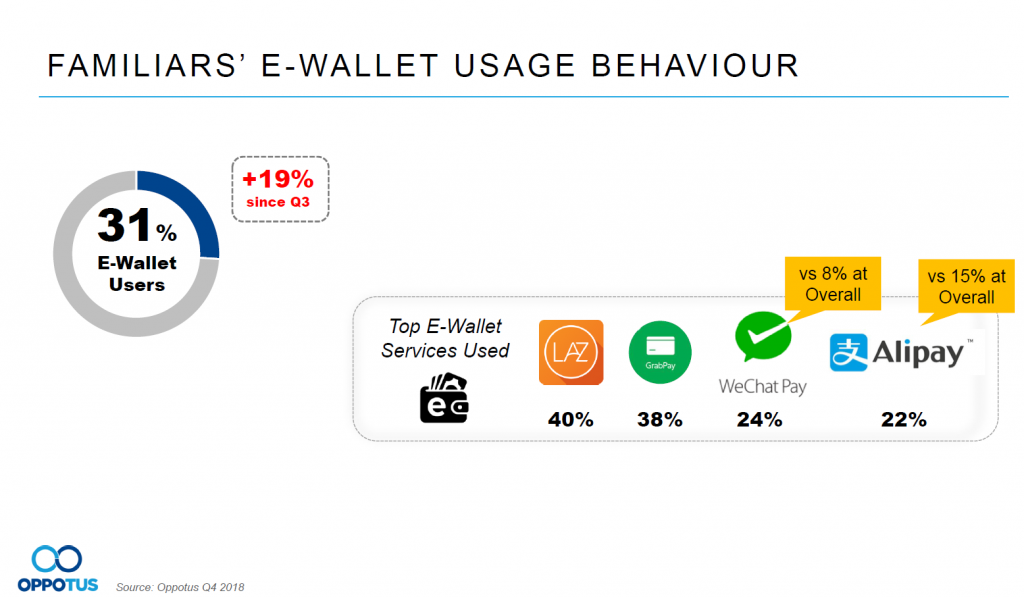

The e-sports industry appears to be particularly promising for e-wallet services, as there has been a 1.6x increase of e-wallet usage amongst e-sports familiars since Q3. WeChat Pay is a notable mention to e-sports familiars, most probably due to its association with mobile gaming, where gamers can use the e-wallet service to purchase in-game items/currency in the form of microtransactions.

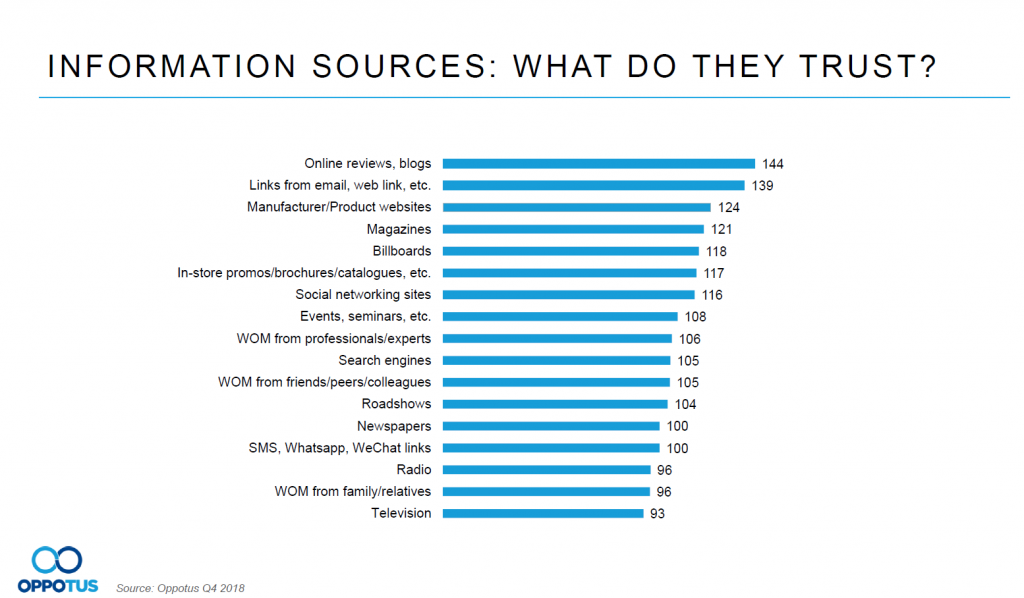

When it comes to reaching and targeting e-sports familiars, it would be best to focus on digital platforms. E-Sports familiars have a strong tendency to look for information through online revives, blogs, emails and web links. Their focused interest on gaming and frequent consumption of digital media makes it easy for market research and digital marketing specialists to figure how best to reach them.

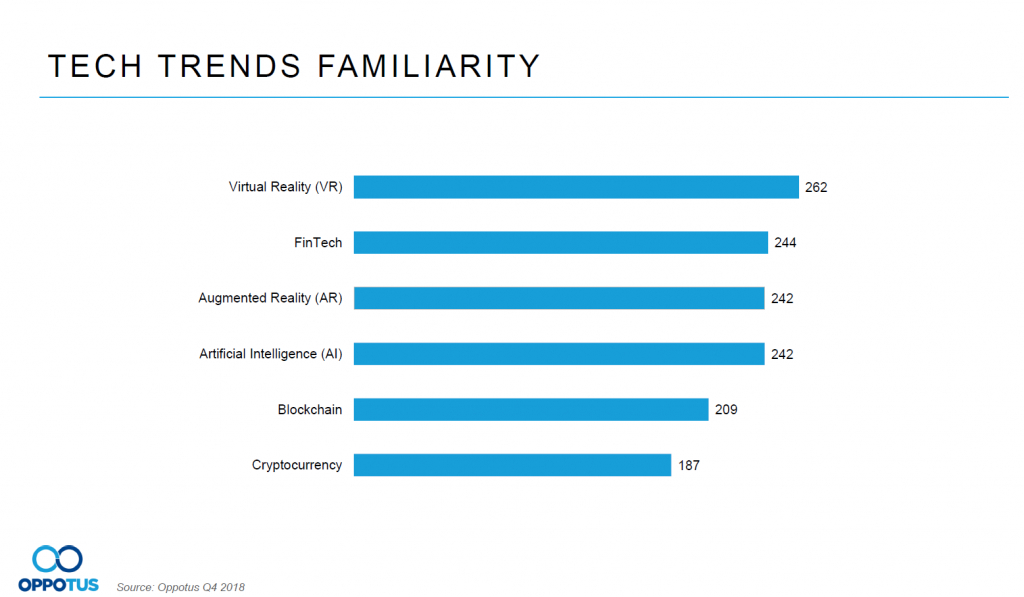

It’s also worth noting that e-sports familiars are much more over indexed on various tech topics than any other consumer groups. Being tech savvy and constantly on digital platforms, they are likely to be familiar with emerging tech trends that most other consumer groups may find inaccessible. If you are involved with VR, fintech or Crypto, then e-sports followers are an audience you cannot afford to ignore.

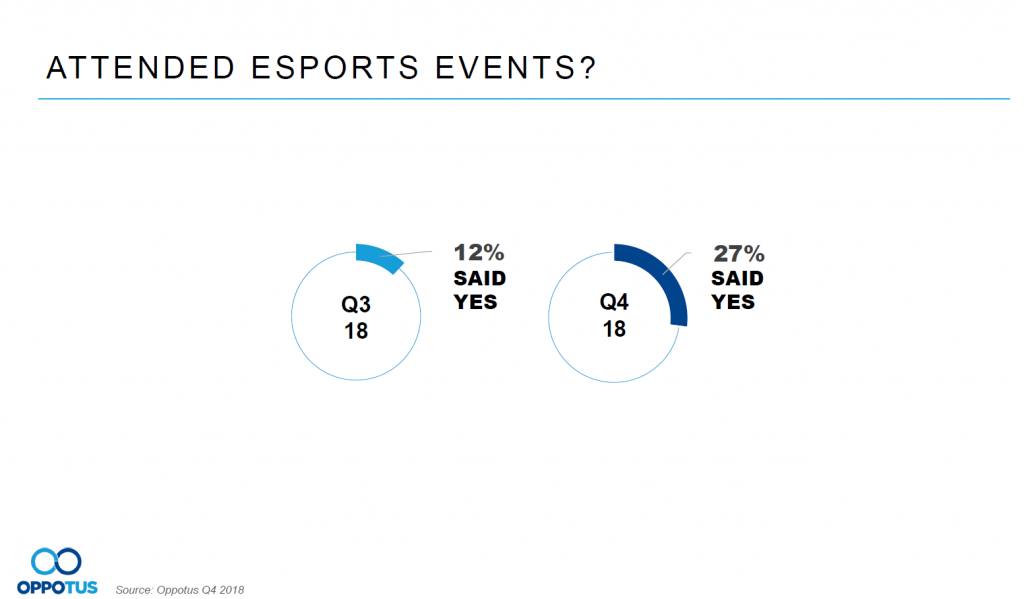

With a 27% attendance rate in Q4, e-sports attendance has grown 2.3x in the span of a single quarter. That is a projected jump from 737,052 to 1,836,000 Malaysians who have attended any e-sports event – a clear indicator that e-sports and e-sports events are enjoying increasing interest and recording higher traction. Those who attend these events also tend to be e-sports familiars, representing a quickly growing demographic. This also makes e-sports events a great investment for brands who wish to gain more exposure for themselves and directly engage with millennials.

When looking at the profile of e-sports attendees, we see once again that it is skewed towards the 18-24 year old bracket and predominantly male.

Conclusion

There has been significant growth in e-sports awareness and familiarity between Q3 and Q4, and thanks to the Malaysian government committing to developing the e-sports industry in Malaysia by supporting events and initiatives across the country, we can expect significant growth to continue throughout 2019.

E-Sports familiars are a steadily growing demographic that displays high levels of familiarity and usage of emerging tech trends, making them a prime audience that can be easily targeted through digital platforms and e-sports events.

Feel free to contact us at theteam@oppotus.com if you are interested in finding out how to enter the e-sports sphere!

This article was updated on the 3rd of May 2023