Welcome to Malaysians on Malaysia: Our quarterly report on the Malaysian Consumer Confidence Index (MYCI). Positioned at a crossroads of evolving consumer behaviors and rapid technological advancements, Malaysia’s 2023 narrative presents a transformative digital journey. In this edition, we highlight the nuances, trends, and pivotal forces shaping this landscape.

This article delves deep into the latest trends and shifts of Q2’2023, highlighting not just the quantitative changes but also capturing the underlying sentiments and driving factors. From e-wallet usage surges to cryptocurrency ownership nuances, the data paints a vivid picture of a nation in digital flux, eager to balance traditional values with modern conveniences amidst a rapidly changing global backdrop. The preceding article on Malaysian consumer confidence in Q1’2023 is accessible here.

MYCI Reflects Stabilization, Echoing Economic and Digital Resilience

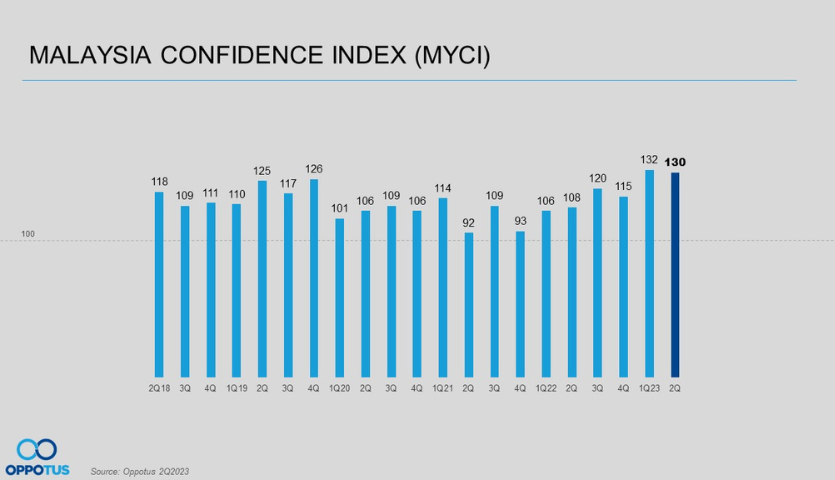

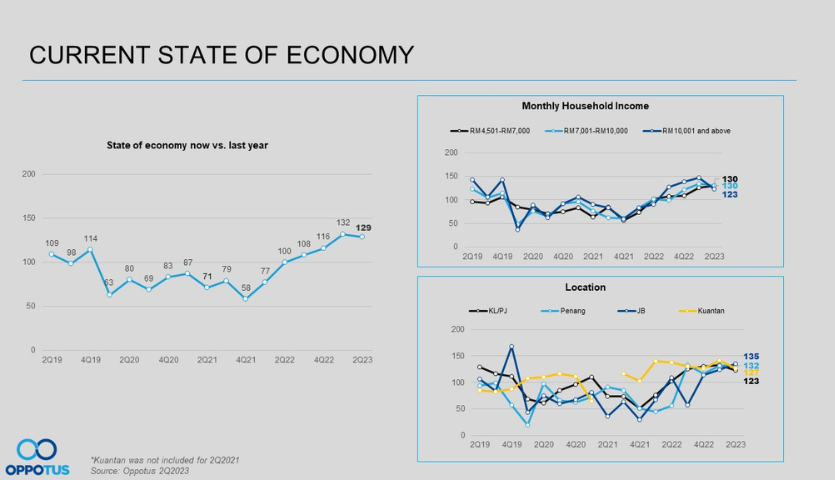

The Malaysian Confidence Index (MYCI), an essential pulse check of the nation, reflects Malaysia’s adaptability and economic resilience. Holding steady at 130 points in Q2’2023, amidst a backdrop of global economic fluctuations, the MYCI underscores the nation’s strength and its adept responses to various challenges.

Beyond these macroeconomic markers, a vibrant digital transformation is taking place. Parallel to this economic narrative is Malaysia’s thrilling digital evolution. As the year unfolds, we’re witnessing a transformative phase in digital consumer behavior, shaped by the widespread adoption of e-wallets, burgeoning innovations in e-commerce, and a redefined relationship with cryptocurrencies. This digital renaissance, juxtaposed against a backdrop of a stable economy, showcases a Malaysia that’s deftly forging its path in a rapidly changing global environment.

Economic Indicators Showcase MYCI’s Consistency

From the onset of 2023, Malaysia’s economic storyline has been one of stabilization and steadfastness. The Malaysian Confidence Index (MYCI) stands as a testament to this, reflecting a robust 130 points in Q2’2023. This consistency, even amidst subtle fluctuations, accentuates Malaysia’s resilient economic fabric. Paired with evolving indicators of financial well-being and underpinned by strategic governmental initiatives, the nation exhibits an unwavering commitment to steady growth. As the calendar pages turn, Malaysians have reasons to maintain their optimism, anticipating a future marked by balanced progress and economic fortitude.

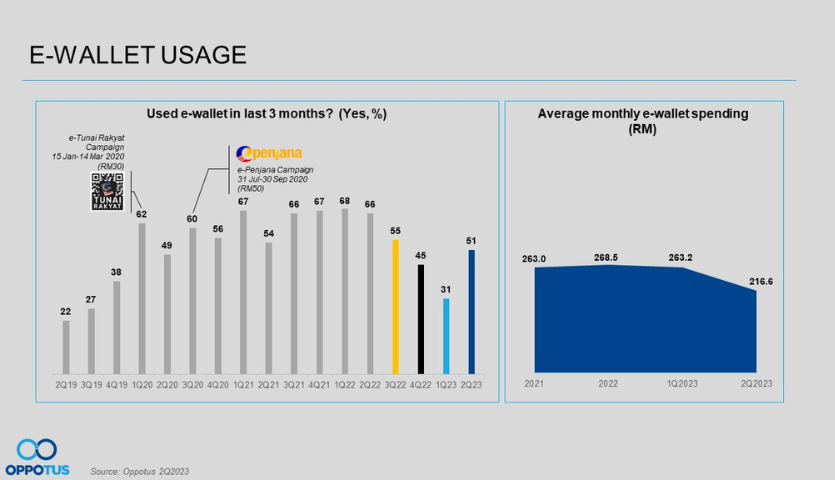

E-Wallet Adoption Resurges, Redefining Digital Transactions

After a period of stagnation, the e-wallet landscape in Malaysia is once again vibrant, marking an uplift in usage to 51%. This resurgence can be attributed to a populace that is increasingly finding equilibrium in the digital realm. However, despite the broadened embrace of e-wallets, the average expenditure per individual has seen a decrease, indicating nuanced shifts in consumer behavior. As the country advances into the digital age, with e-wallets playing a significant role, the challenge for providers will be to understand and adapt to these ever-evolving transactional patterns, ensuring they remain pivotal in Malaysia’s financial ecosystem.

If you’re eager to dive deeper into the numbers and gain a more nuanced understanding of the forces shaping the future of business and finance, don’t hesitate to contact us at theteam@oppotus.com

In the first quarter of 2023, the Malaysian Confidence Index (MYCI) impressively peaked at 132 points. However, by the subsequent quarter, Q2’2023, the MYCI stabilized itself at 130 points. This subtle decline, while noteworthy, isn’t cause for alarm. Periods of stabilization in financial indices are not just common but often indicative of underlying strategic shifts.

Among the factors that could be influencing this transition is the nationwide initiative to strengthen the Ringgit against the U.S. Dollar. Such efforts, while integral for long-term stability, can have short-term impacts on confidence metrics. The annual growth during Q2’2023 slowed to (only) 2.9%, marking the most restrained pace since the third quarter of 2021. This trend might be mirroring broader economic dynamics.

From a domestic front, the current economic climate encourages a shift towards frugality and meticulous financial planning. This sentiment, born out of a challenging economic landscape, undeniably plays a role in shaping indices such as the MYCI. Thus, while there is a slight dip in the MYCI, it should be perceived in light of macroeconomic strategies and individual financial behaviors.

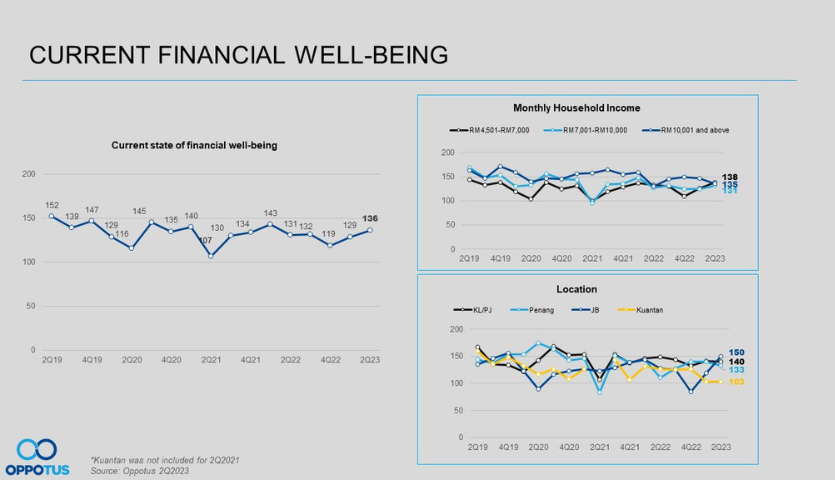

In Q2’2023, the Current Financial Well-Being Index showcased a positive trajectory, rising from 129 points in the previous quarter to 136 points, marking an uplift of 7 points. This promising surge is primarily attributed to the rakyat’s growing trust in the government’s ongoing initiatives. These measures, aimed at stabilizing the prices of essential commodities like vegetables, meat, and eggs, resonate deeply with the fundamental needs of the populace. The impact of these efforts extends to a broader spectrum, influencing the pricing of domestic goods.

Furthermore, Prime Minister Anwar Ibrahim’s vision for a “Malaysia Madani” amplifies this optimism. This comprehensive policy framework, emphasizing good governance, trust, respect, sustainable development, prosperity, and racial harmony, presents a rejuvenated vision for the nation. It underscores the aspiration for a Malaysia that is not only stable and secure but also progressively forward-looking.

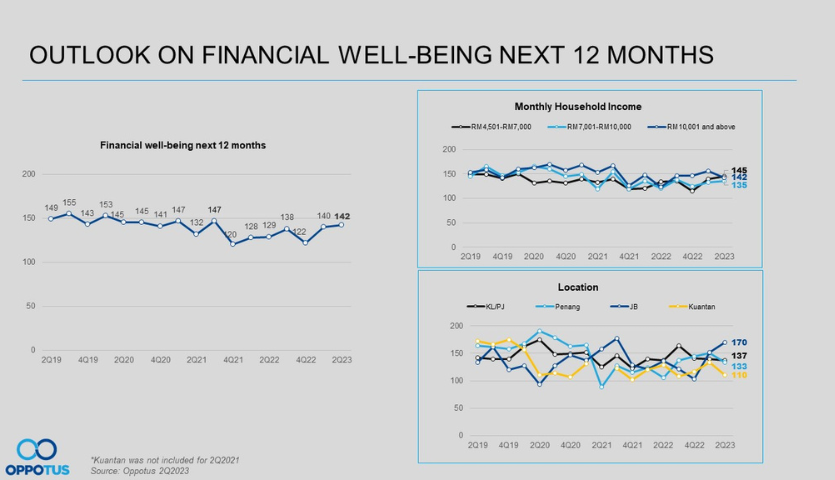

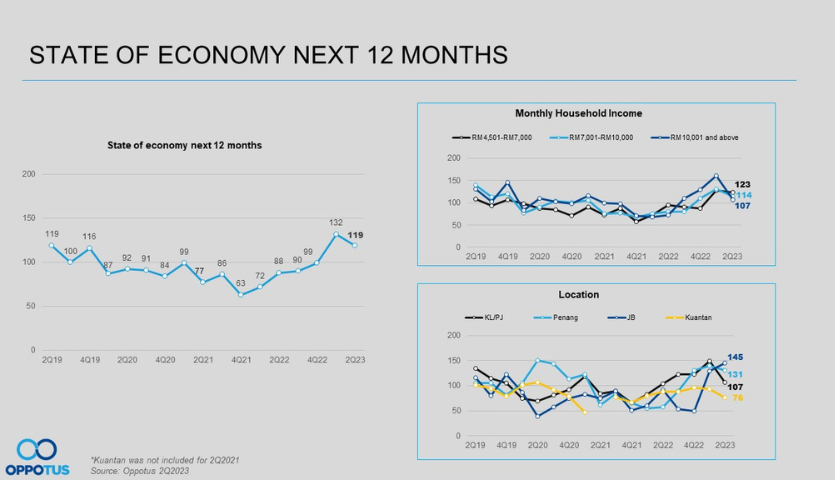

The first quarter exhibited a notable 15% increase in the Outlook of Financial Well-being for the Next 12 Months compared to the close of the preceding year. This fervent growth, by Q2’2023, achieved a stabilization marked by a modest ascent, moving from 140 to 142 points. A particularly salient observation from this quarter’s data pertains to the lower and upper M40 income brackets. These segments experienced a rise, moving from 140 to 145 points and 133 to 135 points respectively.

The pronounced sentiment within these income groups aligns with the heightened confidence of the Malaysian populace in the government’s strategic initiatives. The recent rollout of plans and policies by the administration specifically targets enhancing the quality of life for its citizens. The tangible shifts in these income brackets underscore the positive impact and reception of these government measures on the people’s financial outlook.

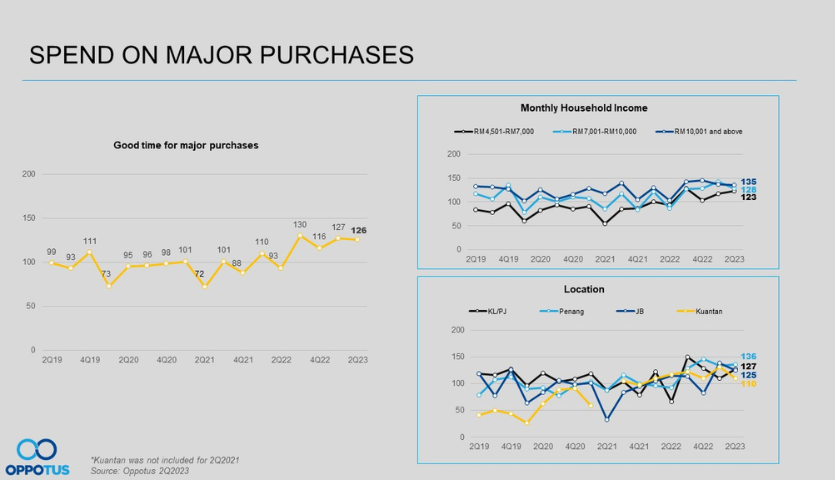

The Spend on Major Purchases index exhibited a marginal dip, moving from 127 to 126 points. This decrement can be linked to a confluence of factors, the most dominant being the waning strength of the Ringgit, which witnessed a notable depreciation of over 5% against the US Dollar within the year. Furthermore, there’s been a discernible dip in the appetite for significant financial commitments, such as property acquisitions and vehicle hire purchases.

The overarching sentiment among Malaysian consumers leans towards heightened prudence. This cautious approach to expenditure can be contextualized by the nation’s tempered economic growth combined with the looming anticipation of further interest rate increments. In such an economic climate, it’s evident that the populace is strategizing their financial engagements with an eye on future uncertainties.

The collective sentiment regarding Malaysia’s Current State of the Economy has experienced a mild ebb, retracting from 132 points to more reserved 129 points. One of the pivotal factors underpinning this shift is the country’s second-quarter annual growth. Registering at a subdued 2.9%, this figure starkly contrasts with the more buoyant 5.6% growth witnessed in the year’s inaugural quarter.

Adding complexity to this outlook are mounting apprehensions around the Central Bank’s capacity to maintain stable policy rates this year. Such concerns have emerged as Southeast Asian nations grapple with dwindling global demand and a perceptible deceleration in trade momentum with China, a critical trading ally. This evolving economic landscape is further corroborated by Malaysia’s export data for July, which manifested a sharper-than-anticipated contraction of 13.1% year-on-year, against economists’ predictions of an 11.3% decline. Similarly, the nation’s import figures have trailed expectations, intensifying the existing economic narrative.

Mirroring the subdued sentiment toward Malaysia’s present economic landscape, projections for the State of The Economy in The Next 12 Months have been similarly tempered. From a robust 132 points in the first quarter, there was a pronounced descent to 119 points by Q2’2023. This trend was resonant across all three income brackets, but it was the most affluent segment, those with earnings exceeding RM10,000, that demonstrated the most pronounced falter in confidence. This group registered a precipitous decline, plummeting from a confident 161 points to a more circumspect 107 points – a stark 54-point reduction.

Amplifying this sentiment, the anticipation of impending state elections in six states (Selangor, Kelantan, Terengganu, Negeri Sembilan, Kedah, and Penang) during the second quarter of 2023 might have contributed to heightened uncertainty. Such significant political events, invariably, infuse a level of uncertainty and provoke contemplation. This, coupled with the broader economic indicators, has evidently deepened the netizens ambivalence about the prospects of a resolute and buoyant economy in the ensuing months.

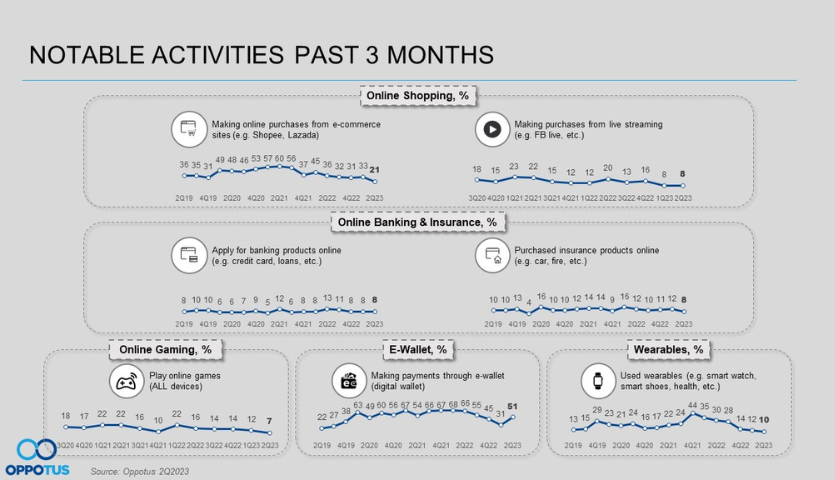

The past 3 months reveal a clear consumer shift. At the forefront of this shift is the rise of digital financial solutions. E-wallets and digital wallets have seen an impressive surge in adoption, moving from 31% to 51%. This not only signifies growing comfort with digital transactions but also perhaps indicates a broader global trend toward cashless interactions. This shift towards digital platforms isn’t uniform, however. Traditional e-commerce sites, for instance, have witnessed a decline from 33% to 21%, marking the lowest engagement levels both pre and post-pandemic.

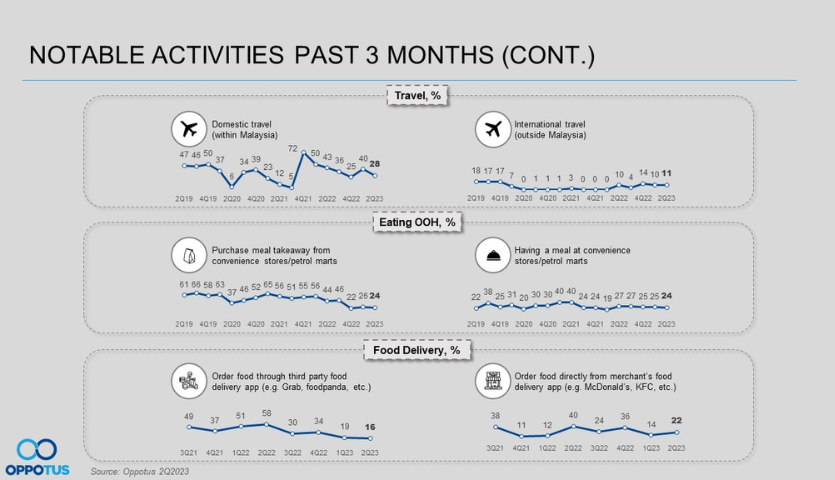

It’s plausible that consumers are seeking more interactive or direct shopping experiences, as evidenced by the stability in online purchases via live streaming, which has held steady at 8%. In a similar vein, surrounding food delivery app usage in 2023, food purchasing trends for Q2’2023 highlight a move toward direct merchant engagements. This points to a discernible shift in trust, as consumers seem to be veering away from third-party delivery services in favor of more brand-specific interactions.

As we observe these digital and shopping behavior shifts, it’s equally crucial to recognize how broader lifestyle changes, like travel habits and technology adoption, further define the contemporary Malaysian consumer. Malaysian travel habits reveal a clear shift, with domestic travel dropping significantly from 40% to 28%, likely reflecting changing local travel sentiments. Alongside, the interest in wearables has seen a subtle slide from 12% to 10%. This trend, while modest on the surface, continues a decline that began in Q4’2021. Such a consistent dip might suggest Malaysians are increasingly cautious about sizeable tech investments, perhaps awaiting market innovations or adjusting to broader economic considerations.

During the second quarter, E-Wallet Usage in Malaysia experienced a significant surge, reaching 51%, a level reminiscent of the figures from Q3’2022. The trajectory of e-wallet adoption in Malaysia, initially molded by the COVID-19 pandemic, has displayed its share of fluctuations. However, the current uptrend suggests that individuals are not only gravitating toward digital solutions but are also finding a renewed equilibrium in their usage patterns. An intriguing counterpoint to this adoption trend is that, despite the increasing number of users, the average expenditure via e-wallets has seen a decline, settling at RM216.6 per individual. This juxtaposition might indicate a cautious approach to digital spending, even as digital transaction methods become more commonplace.

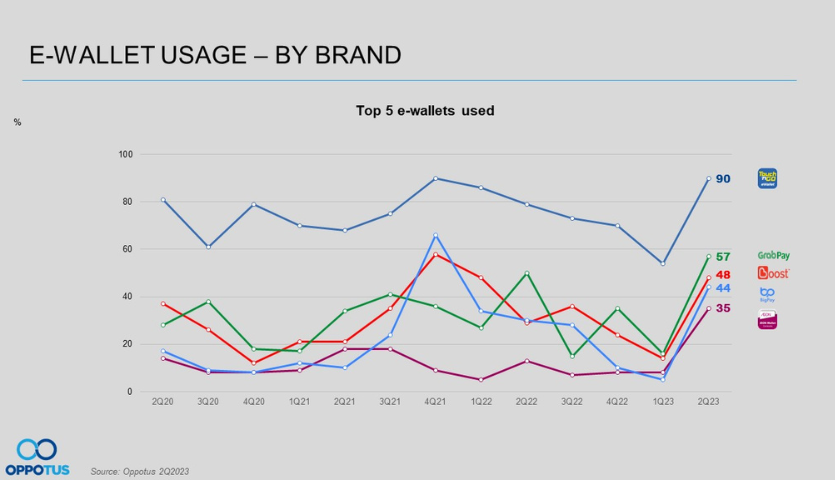

While the first quarter of 2023 witnessed an increase in the usage of bank-affiliated e-wallet services like Maybank QRPay and CIMB QRPay, the current quarter, Q2’2023, tells a different story. Three mobile payment services, although remaining in the top 5, have witnessed substantial shifts in their standings. Touch ‘n Go, steadfast at the pinnacle, has surged impressively from 54% to an overwhelming 90%. This monumental rise can likely be attributed to its recent integration with the DuitNow-NETS cross-border partnership, enabling Malaysians to transact at over 130,000 merchant networks, including the beloved local “kopitiams” and hawkers.

Following closely are Grab Pay, leaping from 19% to 57%, and Boost, ascending from 14% to 48%. But it’s not just the familiar players making waves. New entrants, BigPay at 44% and Aeon Wallets at 35% have staked their claims. The ascent of these e-wallets to the top ranks reflects Malaysia’s evolving mobile payment environment. This shift indicates that consumers are selectively choosing platforms, driven both by the allure of modern features and the implicit value of cost-saving promotions and discounts, ensuring they attain the best user experience and value

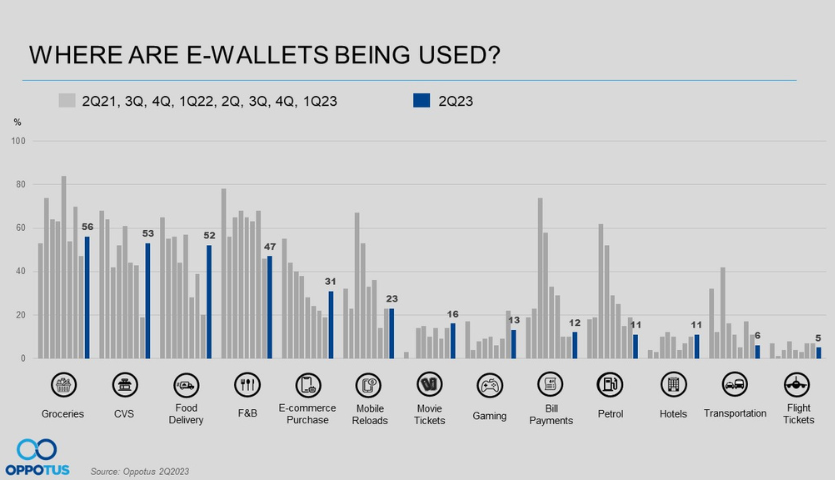

The rising tide of e-wallet adoption in Malaysia is reshaping consumer transaction patterns. While certain sectors consistently rank high in e-wallet transactions, recent data signals a palpable domestic shift in purchase preferences. Specifically, groceries have held their reigning position, seeing an ascent from 47% to 56%, trailed by CVS at 53%. Intriguingly, food delivery app transactions have surged from 26% to 52%, now preceding F&B and e-commerce activities. This pattern underscores a consumer pivot towards domestic necessities over leisure and entertainment. This a clear departure from last quarter’s data, where mobile reloads and gaming ranked within the top five e-wallet transactions.

Navigating the dynamic terrain of Malaysia’s mobile payment ecosystem, it’s evident that recent insights echo the aforementioned trends, especially when examining Malaysians’ future intentions toward e-wallet usage. After a decline to 42% in Q1’2023, there’s a perceptible rebound, with intentions for e-wallet use in the upcoming six months rising to 45%. This renewed confidence might be interlinked with the government’s initiatives to stabilize prices on domestic goods and services, instilling greater confidence among Malaysians to make these purchases.

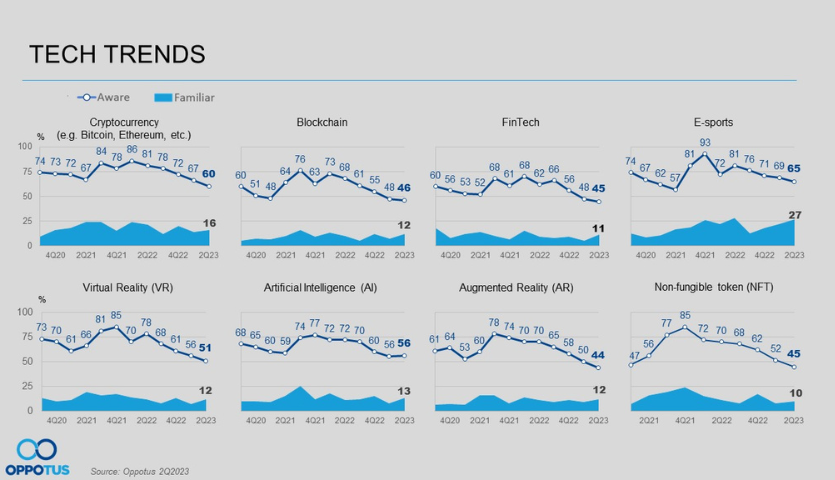

Malaysia stands on the brink of a technological renaissance, with emerging technologies like e-sports, and artificial intelligence offering the potential to elevate the nation’s global prominence. As the country deepens its investments in these groundbreaking areas, it beckons an era where Malaysia could be recognized as a linchpin in the global tech sphere. In alignment with this vision, the prevailing Tech Trends spotlight E-Sports, Cryptocurrency, Artificial Intelligence (AI), and Virtual Reality (AR) as pivotal growth areas.

For the second quarter in a row, e-sports has clinched the top spot among Malaysians’ preferences, although it observed a marginal dip to 65% from its erstwhile 69%. While this decrease might hint at an off-peak gaming season, the broader narrative remains optimistic. With an allocation of 13 million Malaysian ringgit earmarked for the e-sports industry in 2023, the Malaysian government’s ambitions are crystal clear. Highlighting the nation’s concerted efforts to embed e-sports as a staple in Malaysia’s economic, political, and social tapestry, Youth and Sports Minister Hannah Yeoh introduced the National Esports Development Guidelines (NESDEG). More than just an extension of the ‘safe sports code’, this initiative dovetails with the amendment of the Sports Development Act 1997 illustrating the deliberate measures to anchor e-sports within the country’s overarching framework.

Meanwhile, Cryptocurrency has managed to retain its position, even as it recorded a slight drop to 60% from the preceding 67%. Hot on its heels is Artificial Intelligence (AI) at a steady 56%. Interestingly, it has swapped ranks with Virtual Reality, which now stands at 51%, showcasing the fluid dynamics of tech preferences among Malaysians.

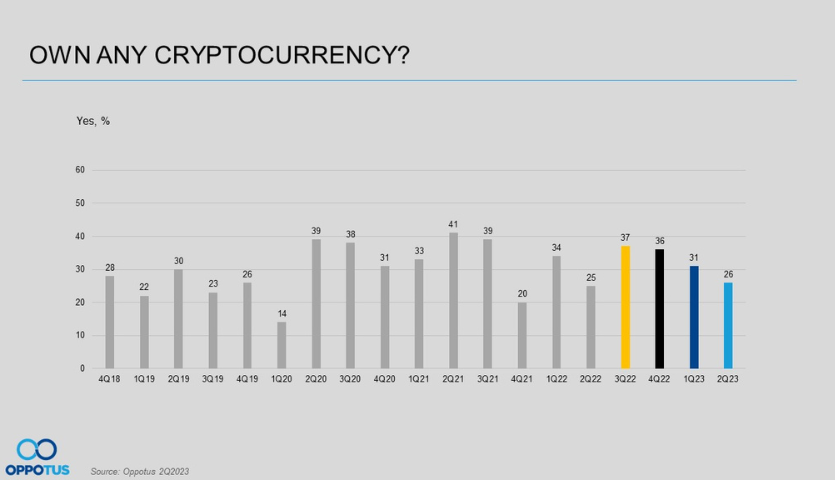

Cryptocurrency ownership in Malaysia has witnessed a subtle yet consistent decline since Q3’2022. Currently, it stands at 26%, down from 31% at the start of the year. Interestingly, this wane comes at a time when Bitcoin (BTC), the leading cryptocurrency by market value, and U.S. stocks are entering one of their historically robust seasonal periods. Data indicates that Bitcoin has posted gains in April in six of the last ten years, averaging an impressive return of over 17%, as per metrics monitored by crypto service provider Matrixport.

This decline in ownership could be influenced by recent developments in the global cryptocurrency domain. The market is still contending with the ramifications of the FTX collapse scandal and its subsequent regulatory repercussions. However, it’s worth noting that the announcement of spot bitcoin ETF applications by major financial institutions has rekindled some bullish sentiment in the cryptocurrency circles. Such juxtaposition of trends highlights the volatile and reactive nature of the crypto market, influenced by both internal and external factors.

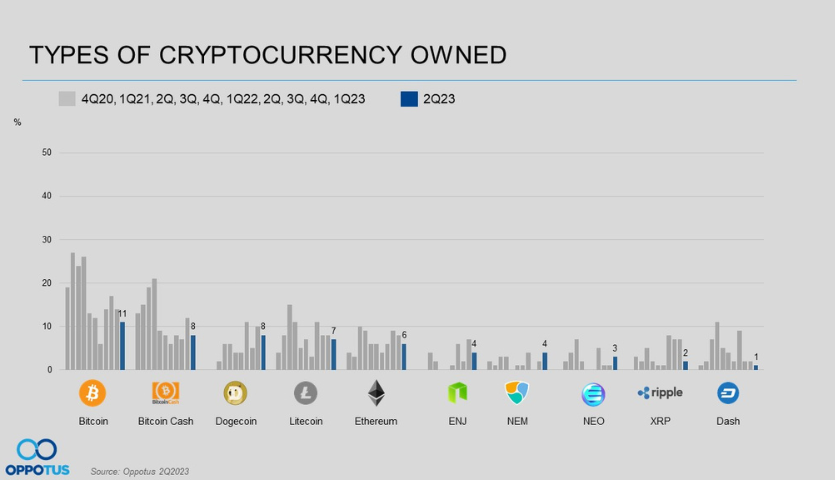

In Q2’2023, the landscape of cryptocurrency ownership in Malaysia underwent some subtle shifts. Bitcoin, although still holding its title as the most popular cryptocurrency, observed a steady decline. From the beginning of the year, when its ownership stood at 14%, it has now dipped to 11%. This trajectory began in Q4’2022 and has continued into the present quarter. Despite this decrease, Bitcoin’s enduring primacy suggests that many still view it with an optimistic lens, banking on its long-term potential.

Following this trend of decline are Bitcoin Cash and Dogecoin. Both cryptocurrencies currently share an ownership rate of 8%, making them the second and third most-held digital assets in the country. Their consistent position, despite the drop, underscores the varied preferences and trust levels of Malaysian investors in the evolving cryptocurrency space. However, it’s important to note that the cryptocurrency market remains volatile and can be influenced by various external factors. For instance, Dogecoin ownership recently surged following a change in Twitter’s logo to “X” by Elon Musk, illustrating the sensitivity of such assets to external news and events.

Note that the opinions presented regarding Malaysia and its people reflect the views of Malaysian citizens aged 18 and above, from both the M40 and T20 income segments, residing in key cities of the Peninsula, and selected in a representative manner.

For a more granular analysis of the data above, we invite you to contact us at theteam@oppotus.com. Our team of experts would be pleased to facilitate a comprehensive review and offer customized recommendations tailored to your specific needs.