Welcome to Malaysians on Malaysia: Our quarterly report on the Malaysian Consumer Confidence Index (MYCI). As Malaysia strives to stabilize its economy and financial status, the MYCI provides valuable insights into the nation’s economic and social outlook. As the nation slowly emerges from the challenges of recent years, the MYCI’s latest report indicates a promising trend towards reestablishing pre-existing lifestyles and newfound practices.

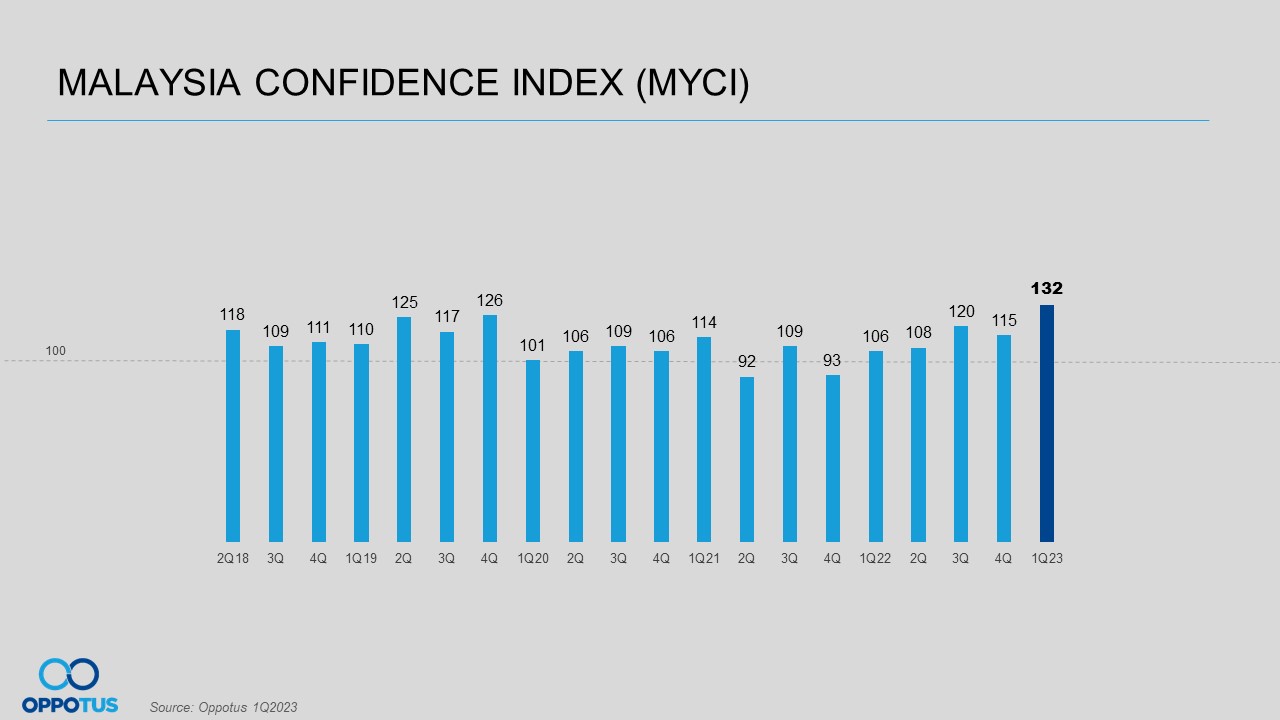

The study shows an all-time high in MYCI’s scores. This suggests a palpable surge of positivity among individuals, despite the ongoing challenges posed by the shifting economic climate. The preceding article on Malaysian consumer confidence in 4Q’22 is accessible here.

MYCI Reached A Record High, Fortified by Robust Financial Indicators

Exciting news from Oppotus, as our MYCI has reached an all-time high at 132 points – marking a positive start to 2023. With the introduction of the 2023 Budget and recent amendments to the Employment Act 1955, there is a rekindled sense of hope that Malaysia is on the path to recovery after a turbulent period wrought by the pandemic’s impact. These developments signify a noteworthy milestone in the country’s journey toward economic resurgence and bode well for a brighter future for all.

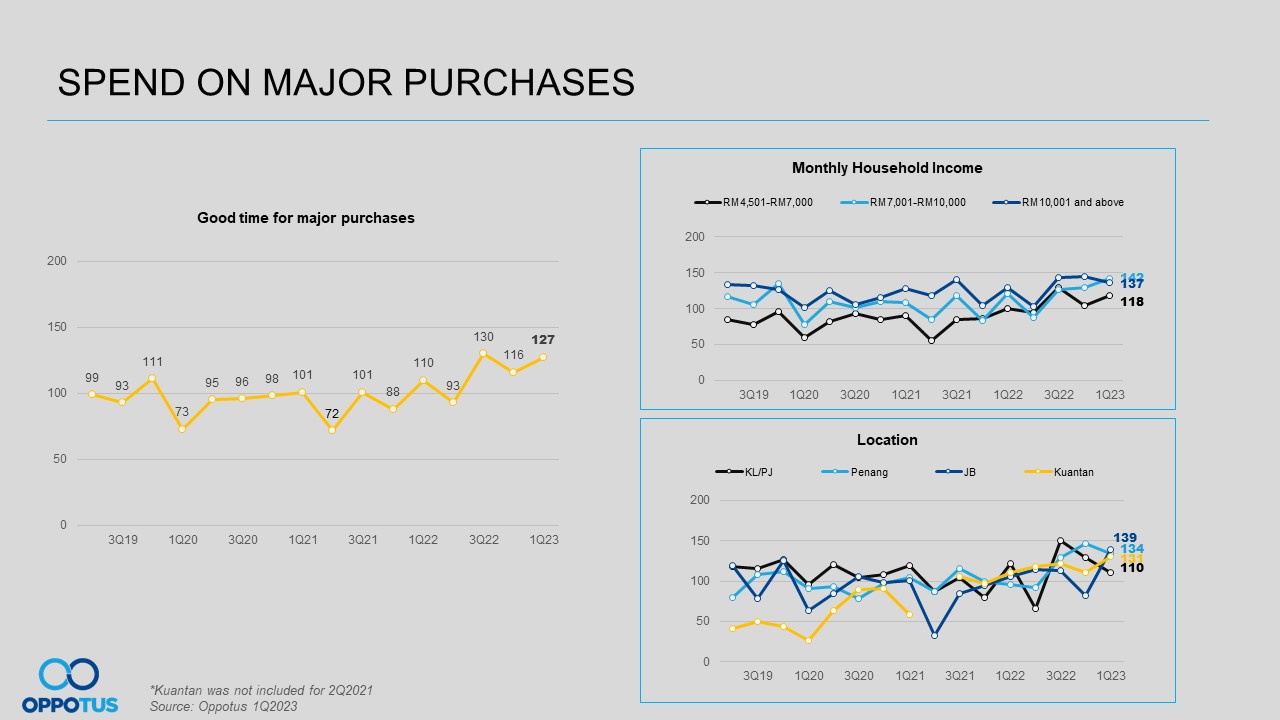

The range of allocated stimulus packages, funds, and financial aid allocated by the 2023 Budget to citizens across different socio-demographic strata has bolstered confidence in the nation’s economic future. Consequently, Malaysians are expressing an optimistic perspective towards major purchases. This, indicating growing confidence in their financial well-being. These developments underscore the effectiveness of the government’s efforts toward ensuring a sustainable and equitable economic recovery.

Economic Indicators Hit All-Time High

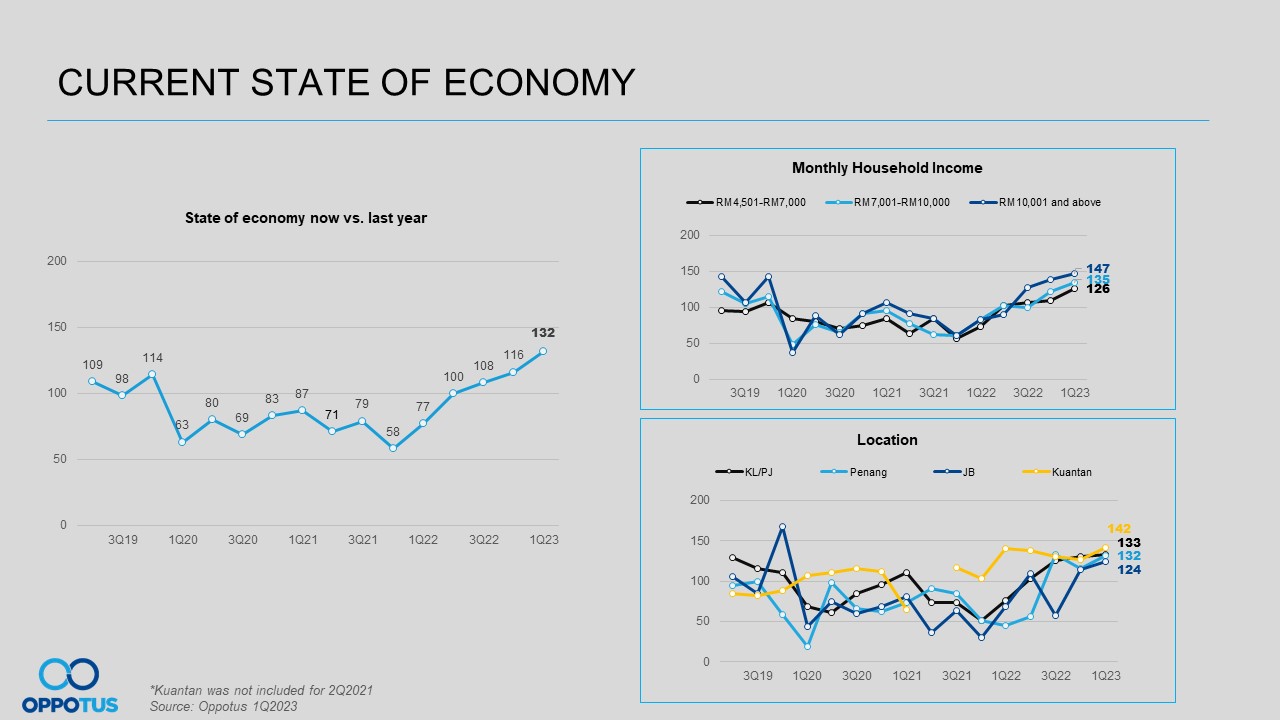

Since the latter half of 2021, our economy has demonstrated a resolute and unwavering climb in its fiscal indicators. This upward trend has continued throughout 2022 and has culminated in the first quarter of 2023, with an unprecedented high of over 130 points. With the new Budget 2023 policies in place, Malaysians can be optimistic that our economy is on the cusp of a new era of growth and prosperity.

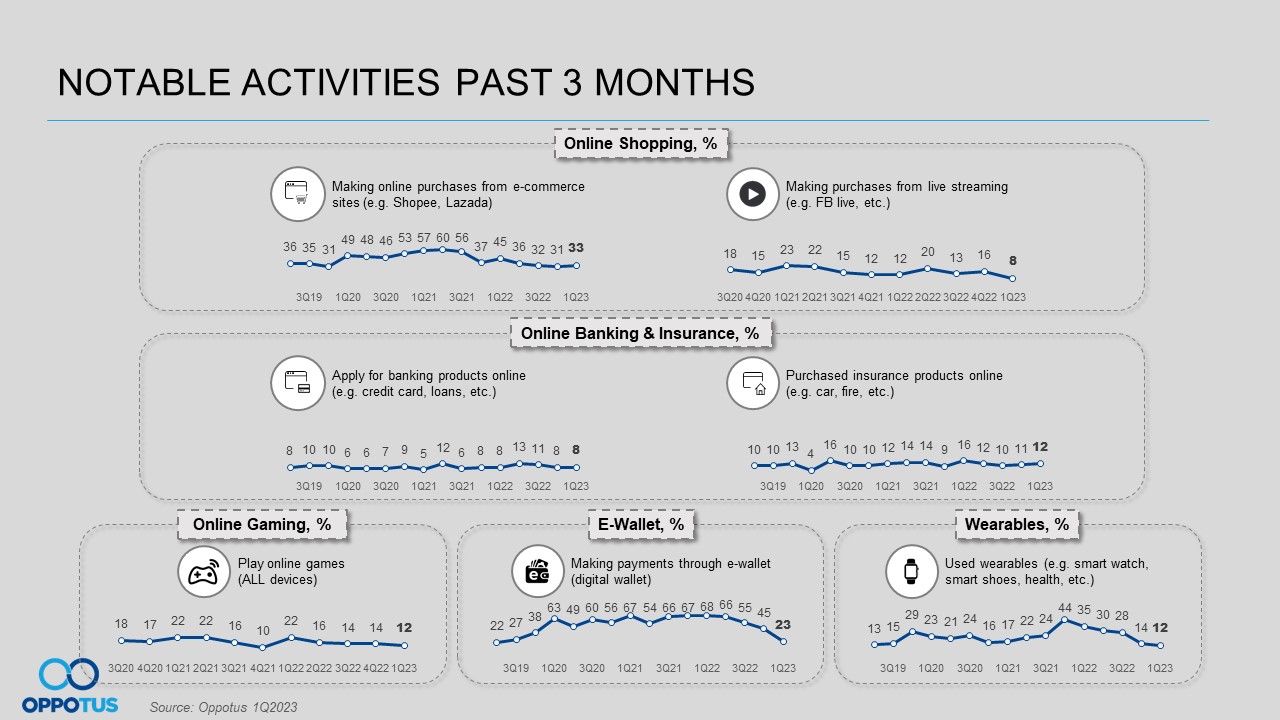

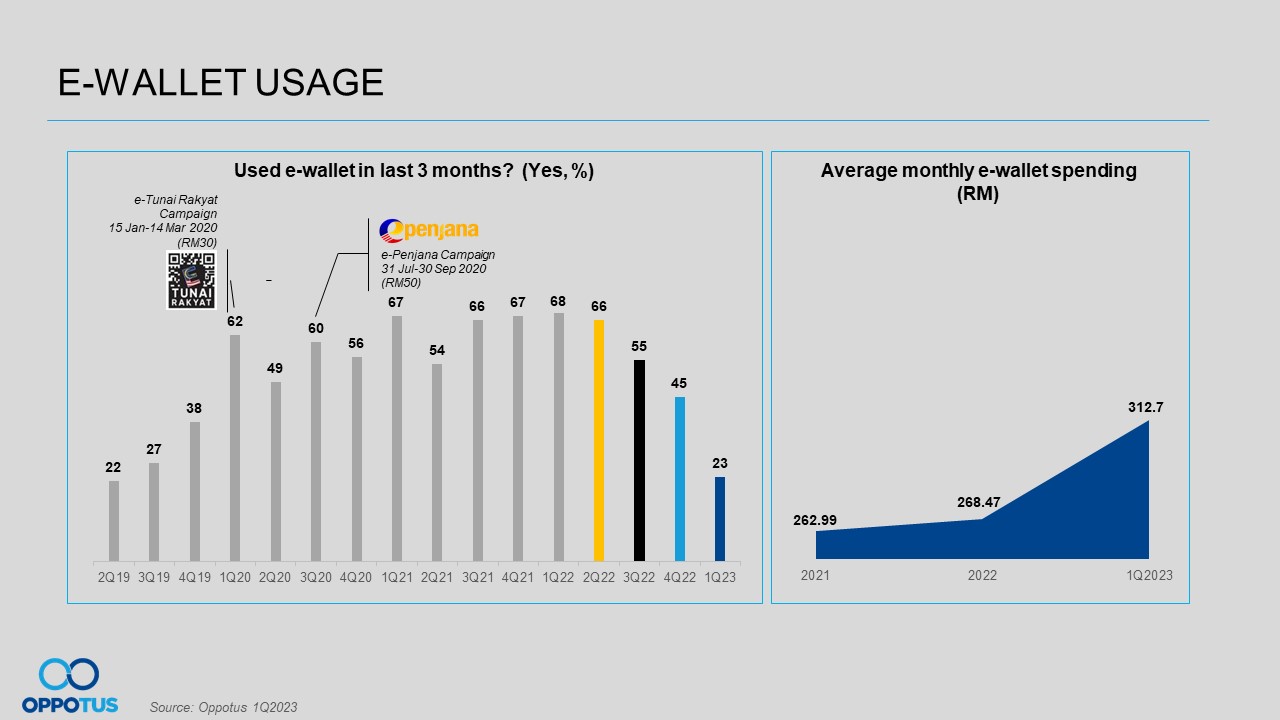

Usage of E-Wallet Continues To Dip

The adoption of e-wallets has stagnated since 3Q’22, with usage rates declining to levels not seen since their initial boom in 2019. In response, e-wallet providers have been resorting to ever-increasing rewards, cashback incentives, and promotions to stimulate user interest and retain relevance in the competitive digital payment market. Fintech’s ongoing evolution and diversification raises questions about whether these tactics are sufficient to sustain the long-term viability of e-wallets as a payment solution.

If you’re eager to dive deeper into the numbers and gain a more nuanced understanding of the forces shaping the future of business and finance, don’t hesitate to contact us at theteam@oppotus.com

For the first time in our MYCI study, we have attained a historic milestone with a record-breaking score exceeding 130 points in the first quarter of 2023. This remarkable feat is a testament to the catalytic effect of recent policy announcements, such as the release of the new Budget 2023 (#Belanjawan2023) and the amendments to the Employment Act 1955, both aimed at uplifting and enhancing the well-being of both citizens and the working population. These developments have instilled a palpable sense of positivity, creating a promising start to the year 2023.

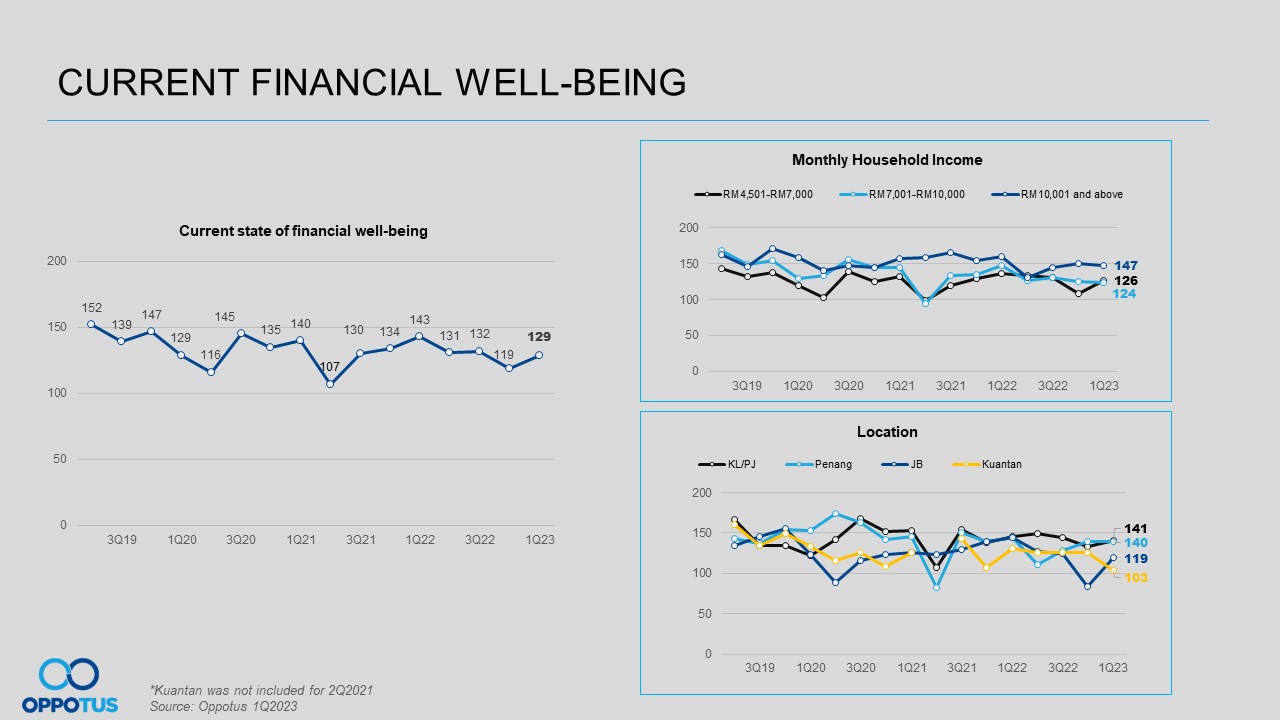

The recent data indicates a notable surge in Malaysians’ perception of their Current Financial Well-being. There has been a discernible upward spike of 8% in this regard, indicating growing confidence in their financial stability. The government’s proactive efforts toward maintaining macroeconomic stability and implementing measures to enhance microeconomics, including improving labor market conditions, have undoubtedly played a pivotal role in this positive shift.

Additionally, the more targeted subsidy framework, including those benefiting lower-income households, has also played a crucial role in enhancing citizens’ financial well-being. The government’s policies, such as the hike in the minimum wage and provision of monetary assistance through the “Bantuan Keluarga Malaysia” (BKM) program, have also undoubtedly provided essential support, further contributing to this positive trend.

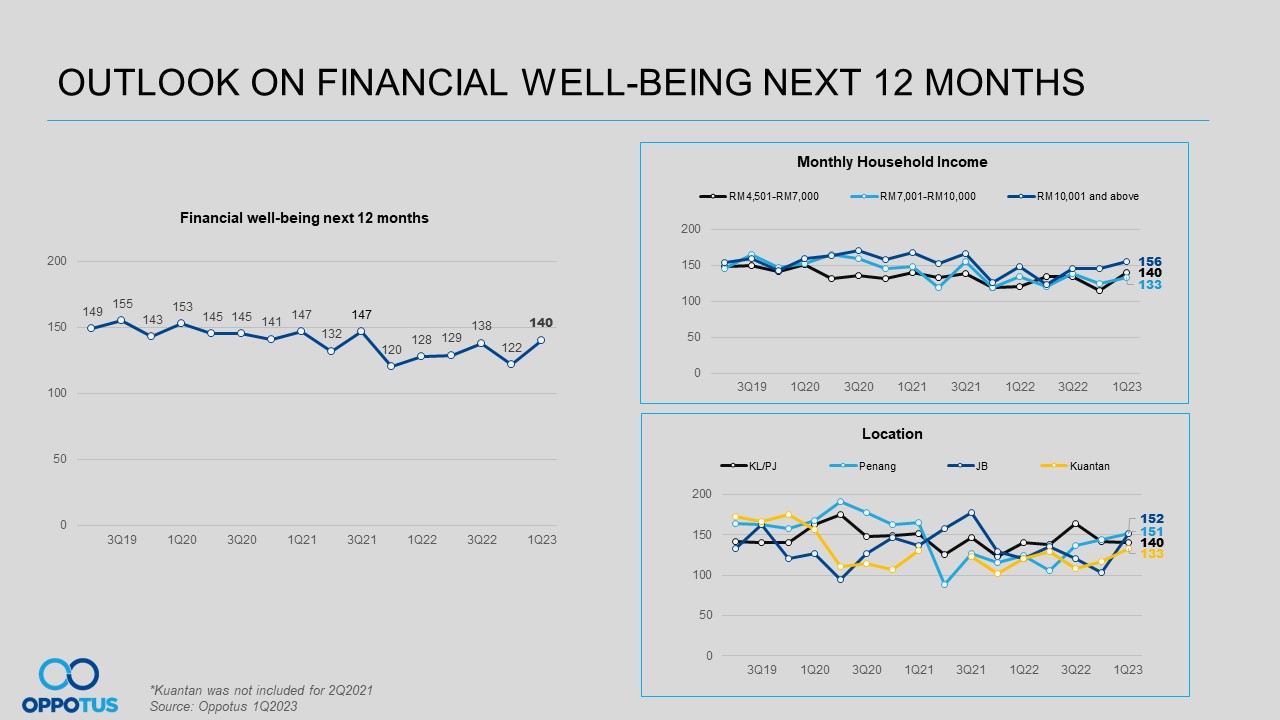

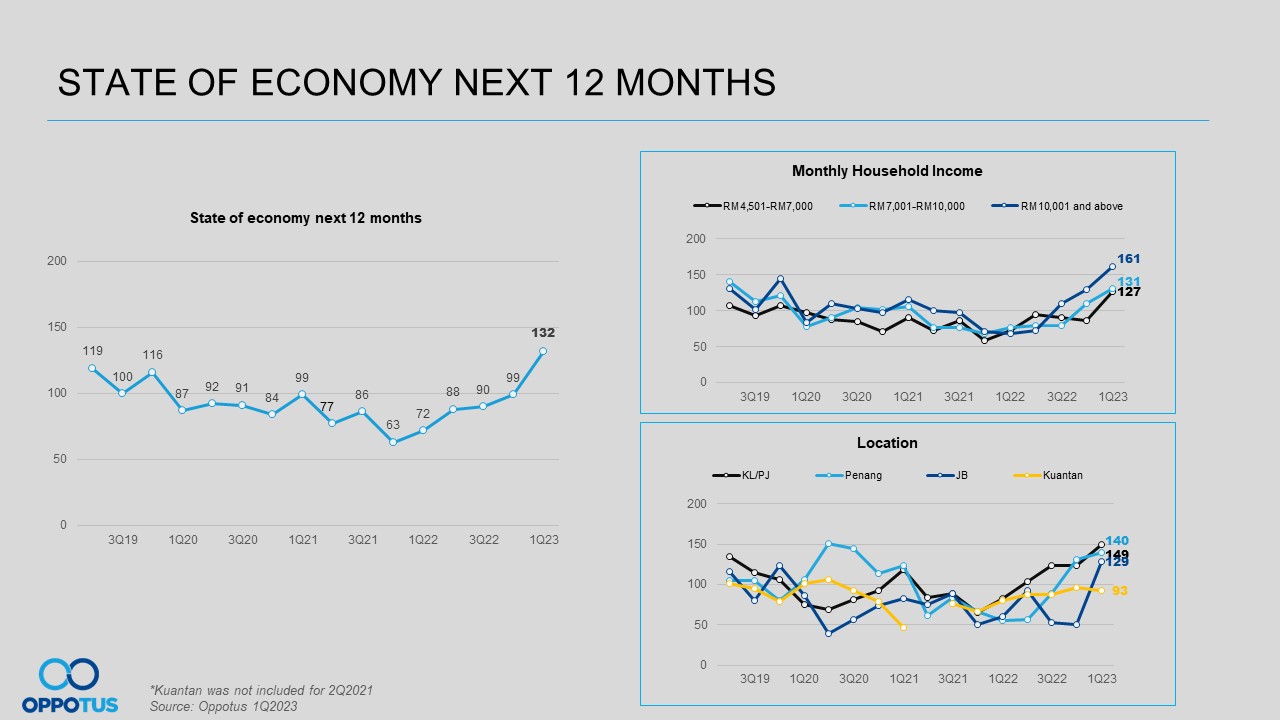

Given the aforementioned, it is clear that there will be a spill-over effect on the Outlook of Financial Well-being for the Next 12 Months. This is demonstrated by a remarkable increase from 122 points at the close of 2022 to 140 points in the first quarter of 2023, highlighting a significant 15% upsurge. Thusly, it is worth noting all income groups are experiencing an upward trend, with a considerable surge observed among the lower M40 income bracket, earning between RM4,501 to RM7,000, demonstrating a noteworthy increase of 28%.

Data reveals a 9% increase in our Spend On Major Purchases index. Malaysians’ sentiment towards financial well-being indicators has been positive, thus signifying a favorable climate for major purchases. We can attribute the driving force behind this trend, at least in part, to the upcoming Raya celebration, which has caused an increase in this indicator.

Malaysians’ outlook toward the Current State of the Economy has shown a remarkable recovery since the significant dip it experienced in the latter part of 2021. This positive uptrend spanned four consecutive quarters in 2022. Notably, the indicators have, to date, reached an unprecedented high, standing at a record-breaking 132 points. This milestone reflects the consistent sentiment of confidence among the populace toward the state of the economy. Overall, this positive trend is a testament to the country’s resilience and reflects a hopeful outlook.

Coupled with their positive outlook on the current state of the economy as highlighted above, Malaysians also demonstrate a confident stance towards the State of The Economy in The Next 12 Months. The index has experienced a surge, surpassing the threshold of 130 to attain an impressive 132 mark. This dramatic increase has marked a distinct departure from the prior trend of stagnation, wherein the index had remained within the points of 90 to 99 during the preceding two quarters of 2022. The significant upturn in value marks a notable milestone in the trajectory of the index, underscoring its potential for growth. The data shows that all three income brackets exhibit a positive satisfaction trend, with the lowest bracket (earning RM4,501 to RM7,000) demonstrating the highest upward trajectory.

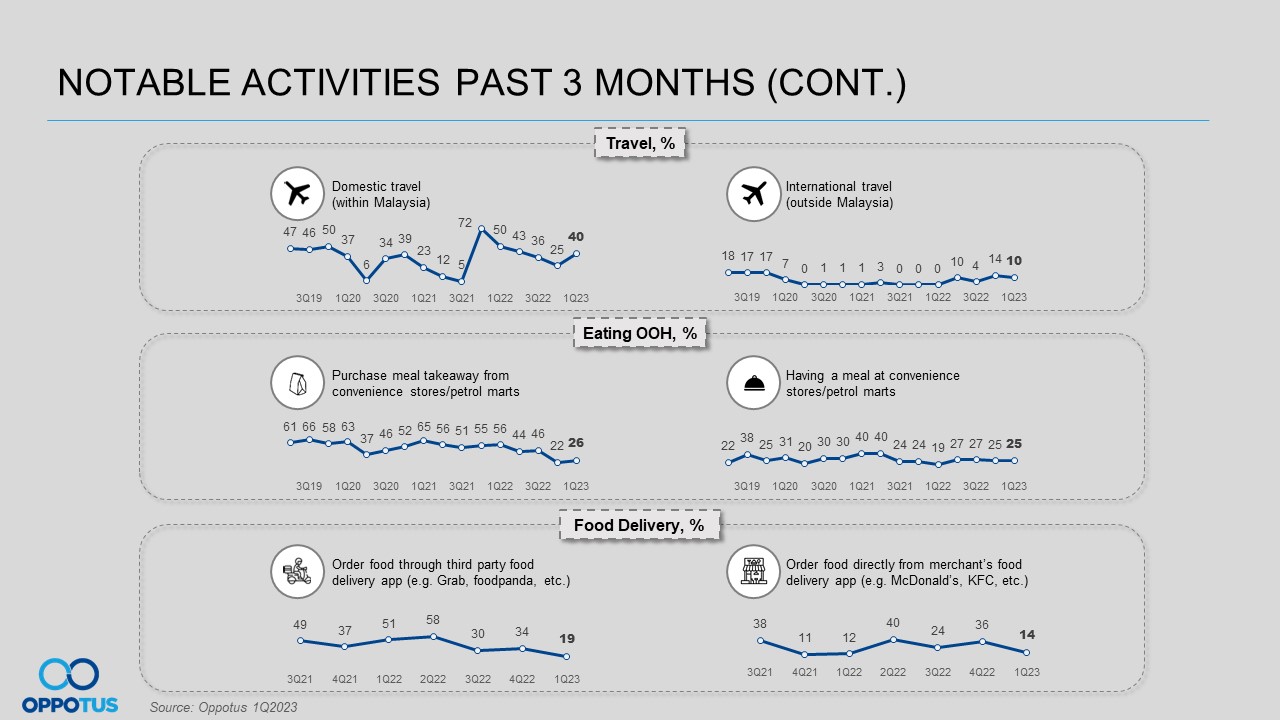

Over the last three months, we have also looked into a prominent area of interest and engagement that has revolved around travel, particularly within the domestic sphere. This recent upswing in activity has been marked by an escalation of up to 40%, which can be attributed to a confluence of two critical events. Specifically, Chinese New Year in January and the one-month hiatus concluding at the end of the school year in February. Conversely, there has been a slight dip in international travel during this timeframe, which may signal a degree of reluctance among individuals to partake in sizable investments early in the year. The trend of cautious spending is also evident in the stabilizing patterns of online banking and insurance purchases.

Our data has shown that there has been a plateau in the rate of dining in at convenience stores and petrol station marts, remaining at a steady rate of 25%. This has occurred concurrently with a significant decline in the usage of direct merchant and third-party food delivery apps. These findings suggest that people may be more inclined to venture out and experience in-person dining, leading to decreased food delivery app usage in 2023. Despite the challenging macroeconomic climate, this trend indicates a renewed vigor for dining out.

As the first quarter of 2023 drew to a close, E-Wallet Usage in the past three months has continued to decline and has now dropped to 23%, levels observed during its initial boom in 4Q’19 when the e-wallet landscape in Malaysia was shaped by the COVID-19 pandemic. With the return to equilibrium, the hype surrounding e-wallets during the pandemic – when cashless transactions were highly encouraged – has taken a toll.

The divergence from e-wallet usage could be attributed to people going back to more conventional pre-pandemic payment methods, such as cash (preferred by 45% of individuals), followed by direct debit and online bank transfers. Despite this decline, the average expenditure on e-wallets has remained steady year-on-year. However, we observed a noticeable 17% spike in spending during this three-month period after 2022, with an average monthly expenditure of RM312.70 per person.

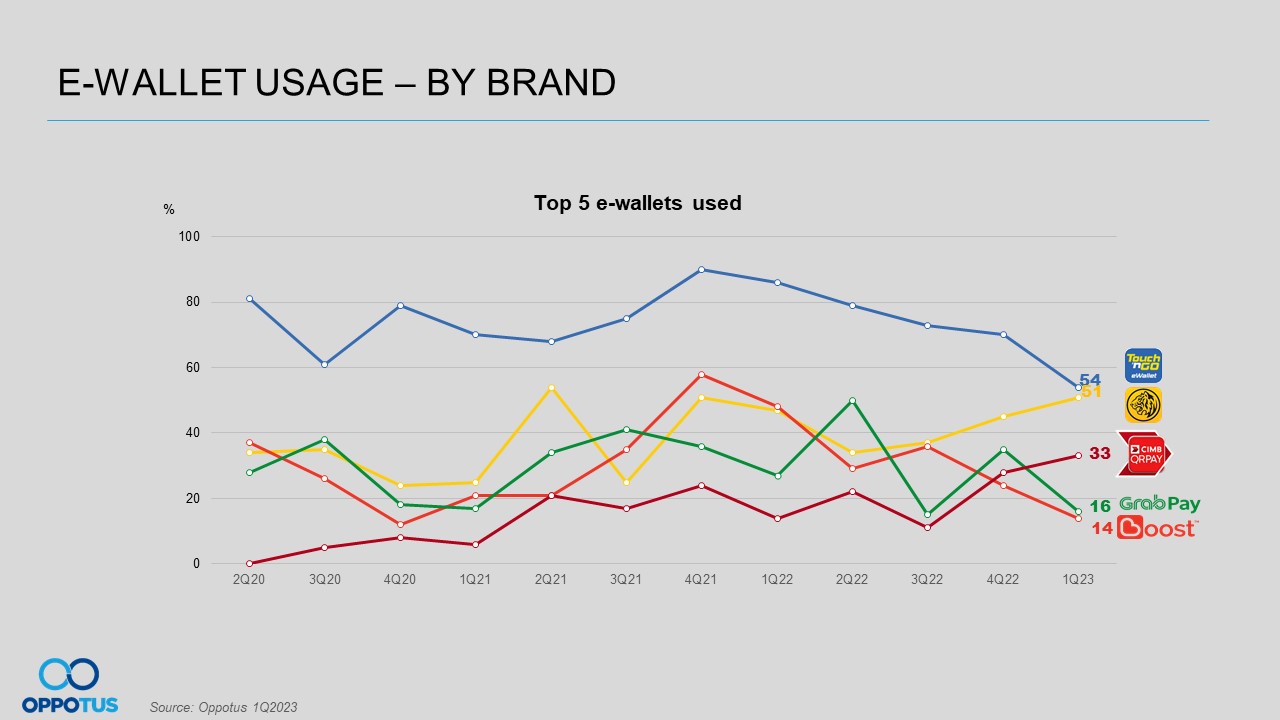

Currently, there is a marked trend in the mobile payment services industry, as the usage of bank-provided e-wallet services, such as Maybank QRPay and CIMB QRPay, has gradually increased, by 13% and 17%, respectively. In contrast, despite being identified as the market leader in 4Q’22, Touch ‘n Go e-wallet, along with other conventional e-wallet players such as GrabPay and Boost, has experienced a decline in usage.

This phenomenon is closely associated with the inherent nature of QR Pay services that directly link to bank accounts, rendering them more convenient to use than conventional e-wallet players. Therefore, this convenience attribute harbors the potential to fuel the escalation of bank-provided e-wallet players’ usage rates in the market.

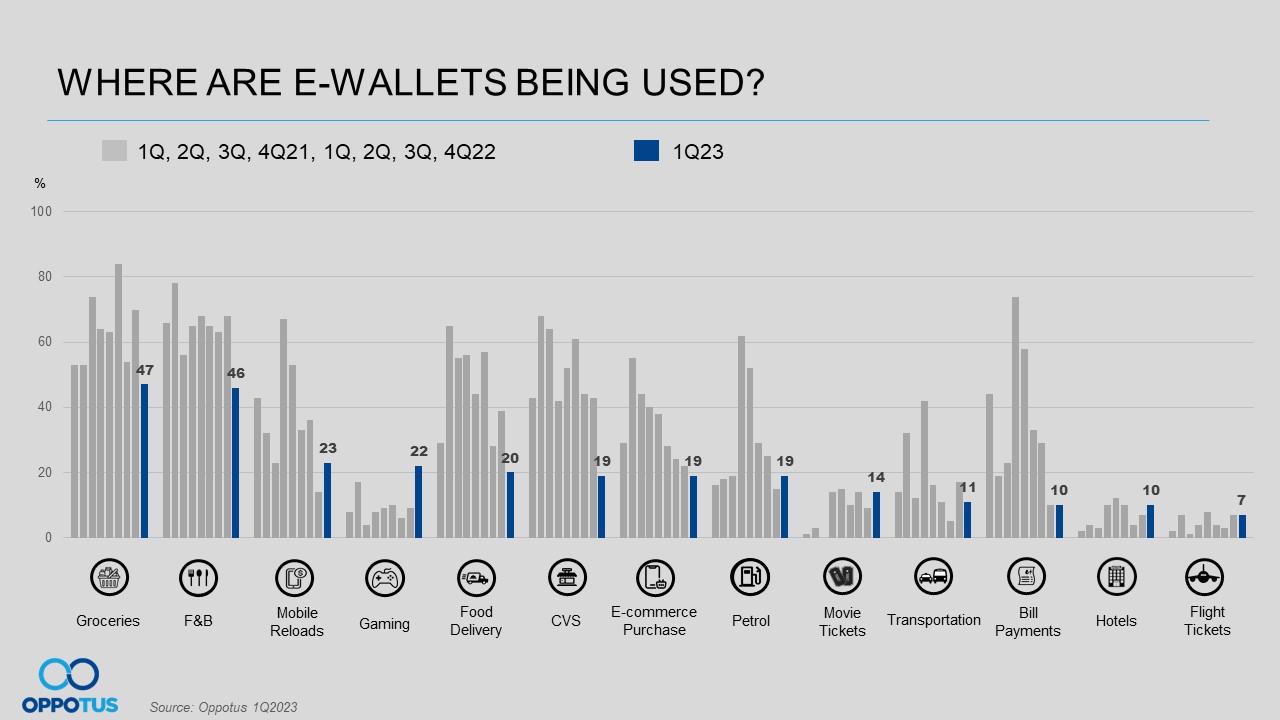

Despite the overall decline in e-wallet usage rates, recent data shows that certain sectors remain the most popular for e-wallet transactions. Specifically, groceries and F&B continue to be popular, while gaming and mobile reload are gaining traction – overtaking food delivery and CVS by a substantial amount. Contrary to the previous quarter’s findings that ranked Malaysian food delivery apps among the top 4 e-wallet payment options with a 39% margin, our current data suggests a shift in trend with a gradual drop. Interestingly, e-wallet usage is also gaining traction in other niche activities such as movie ticket purchases, and hotels. This trend suggests a growing acceptance of e-wallet services among consumers in a wider range of sectors as we’ve reverted back to the pre-pandemic physical norms.

Amidst the ever-changing landscape of Malaysia’s mobile payment industry, recent data aligns with our above findings that show a significant shift in Malaysians’ intention toward e-wallet usage in the upcoming six months as well. The previously optimistic figure of 72% has now plummeted to a mere 42%, indicating a clear deviation from the earlier trend.

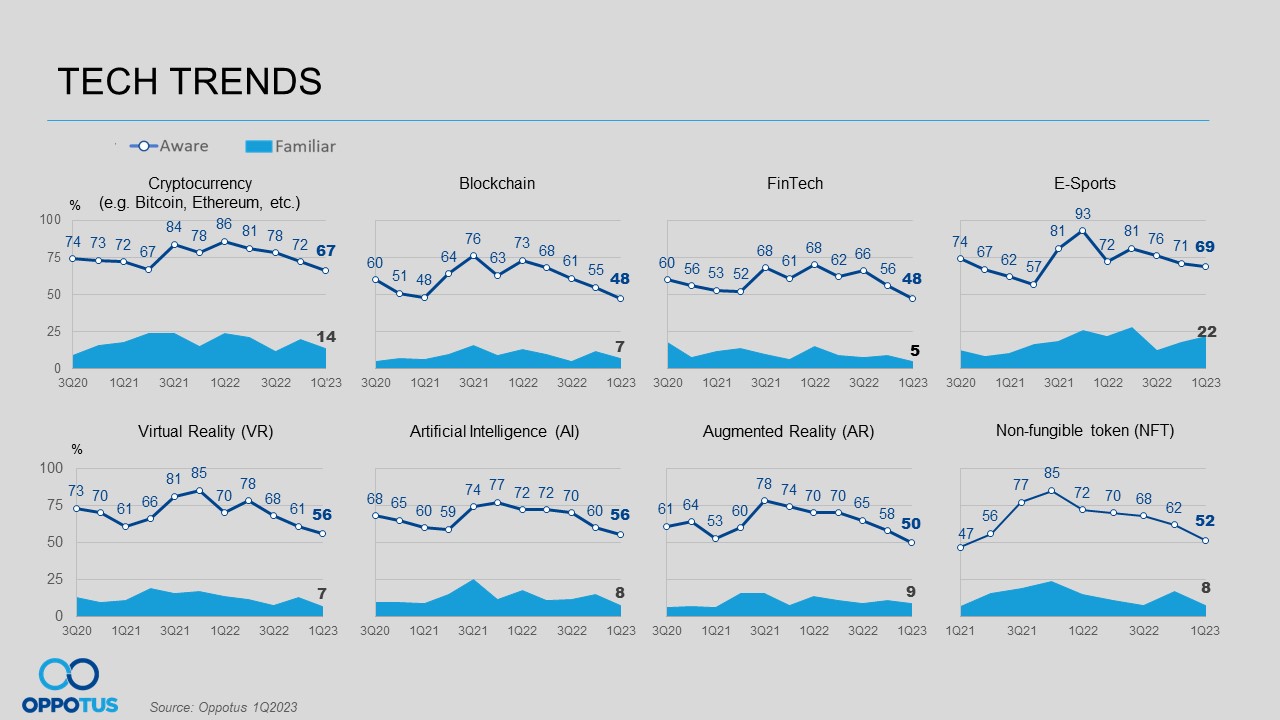

Emerging technologies have the potential to transform Malaysia’s position at the global forefront. With advancements in artificial intelligence, blockchain, and the Internet of Things (IoT) reshaping industries and driving innovation. As Malaysia continues to invest in these technologies, it has the opportunity to solidify its position as a key player in the global tech landscape. Congruent to this, the top four Tech Trends, are E-Sports, Cryptocurrency, Virtual Reality (VR), and Artificial Intelligence (AI).

E-Sports is the top choice among Malaysians this quarter, overtaking Cryptocurrency, securing the first position with a 69% share. Cryptocurrency has secured the second position with a 67% share. This is closely followed by Virtual Reality (VR) and Artificial Intelligence (AI), both tied at 56%. The slight drop in interest in cryptocurrency could be a ripple effect from the collapse of the crypto exchange FTX in November 2022. In spite of this, the data highlights a growing inclination towards immersive and intelligent technologies among Malaysians.

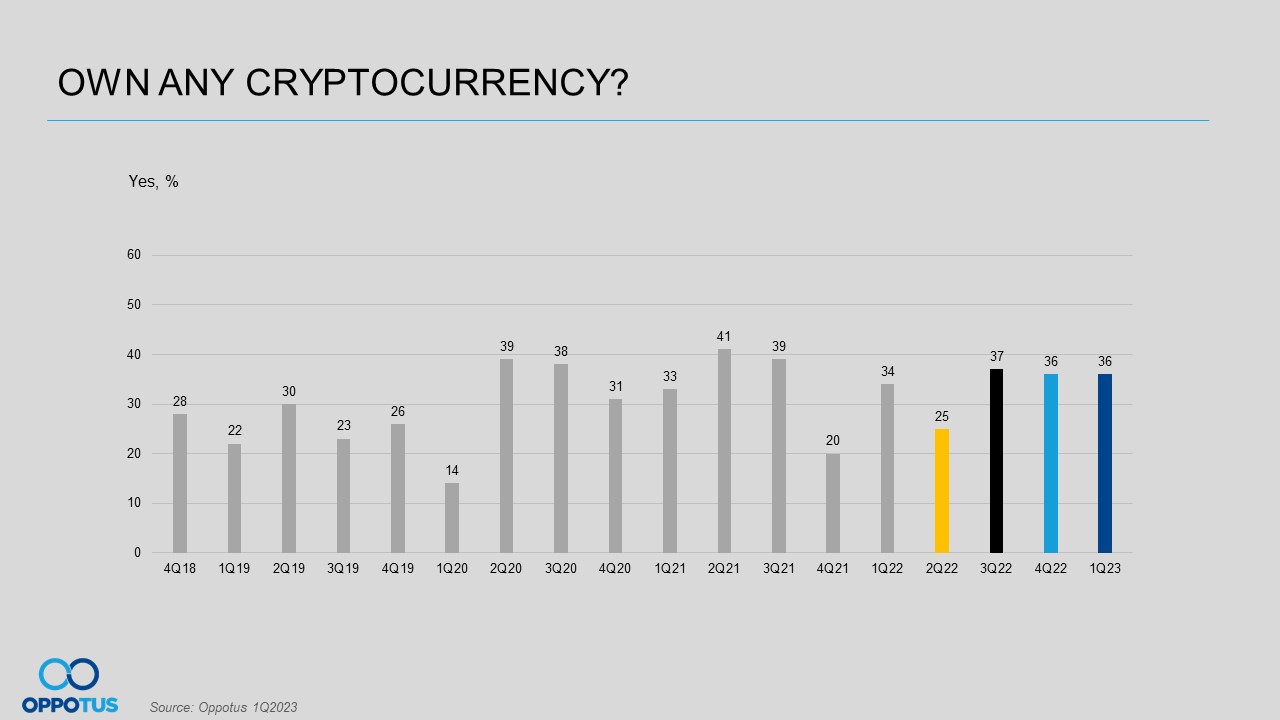

There has been no significant change in Cryptocurrency Ownership during the 1Q’23, as it has remained stable at 36%. This data suggests that despite the volatility and unpredictability of the crypto market, during a period dubbed the “crypto winter”, there is still a considerable portion of the population who have chosen to retain their investments in this particular asset class.

Investors may hold a positive outlook toward the resilience of Bitcoin and cryptocurrencies due to historical evidence of the market’s ability to defy expectations even during periods of decline. With an unwavering appetite for cryptocurrencies, individuals may deem it fit to shift towards licensed, and regulated platforms. An example of this would be Luno Malaysia, under the protection of the Securities Commission Malaysia (SC).

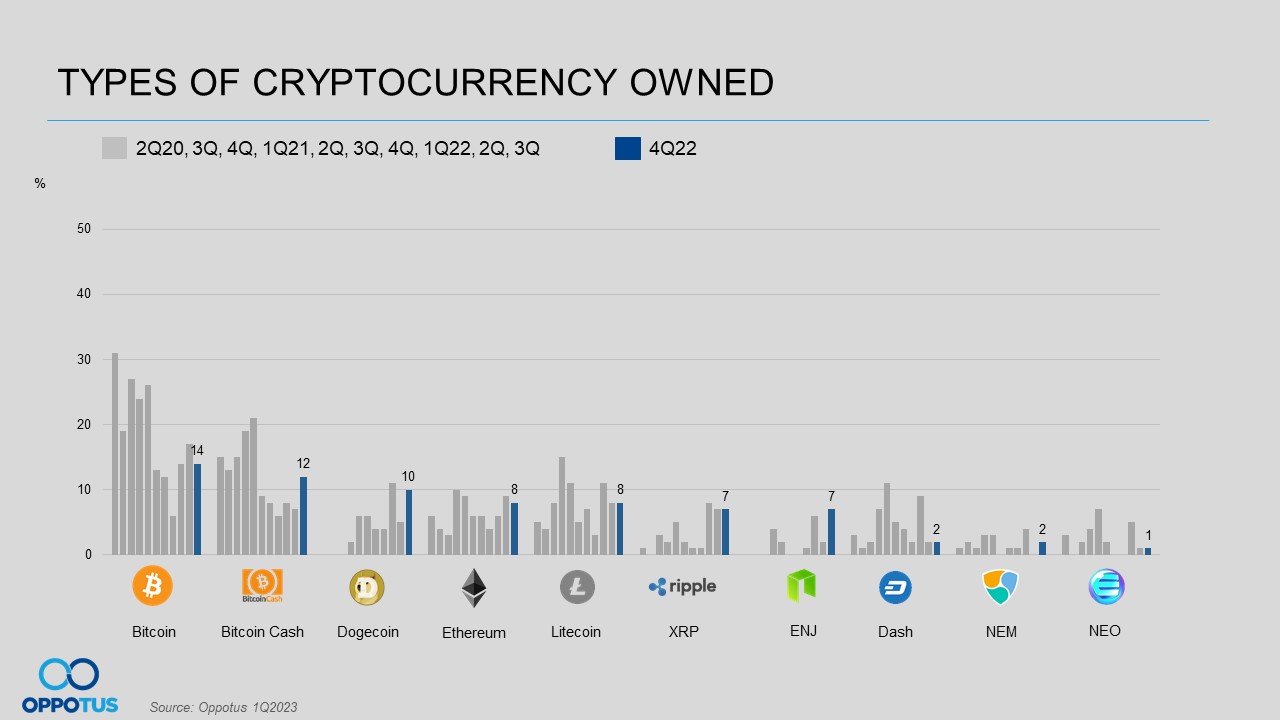

The data reveals that Bitcoin ownership underwent a decline in the first quarter, dropping from 17% to 14%. Nonetheless, Bitcoin still retains its position as the most widely held cryptocurrency. The positive outlook on Bitcoin may stem from people’s optimism towards the crypto currency’s potential.

Sentiments in which shared by Standard Chartered, the global banking firm, predicted the era of the “crypto winter” may be behind us. Further detailing Bitcoin prices could surge to $100,000 by the close of 2024. Presently, Bitcoin’s value stands at a significant distance from this projected amount. Its digital currency trade has fluctuated between $30,000+ to $27,00.00+ at the time of preparing this MYCI report. Conversely, other cryptocurrencies such as Bitcoin Cash, Dogecoin, ENJ, and NEM have exhibited a noticeable increase in ownership.

Note that the opinions presented regarding Malaysia and its people reflect the views of Malaysian citizens aged 18 and above, from both the M40 and T20 income segments, residing in key cities of the Peninsula, and selected in a representative manner.

For a more granular analysis of the data above, we invite you to contact us at theteam@oppotus.com. Our team of experts would be pleased to facilitate a comprehensive review and offer customized recommendations tailored to your specific needs.