Q4’2025 Update: Consumer Confidence Maintains Steady Trajectory

Welcome to Malaysians on Malaysia (MOM): Oppotus’ quarterly report that provides in-depth insights into the Malaysian Consumer Confidence Index (MYCI). It is an ongoing effort to offer insights into Malaysia’s evolving market landscape. This edition delves deeply into the latest consumer trends and key influencing factors, including financial outlook, economic confidence, digital payments, tech trends and more, offering a fresh perspective for strategic decision-making. Join us as we unravel the driving forces of this quarter and its potential implications.

Consumers’ confidence in the fourth quarter holds a steady outlook, which is reflected in our MYCI index. During this quarter, several major events took place, including hosting of the 47th ASEAN Summit, which put Malaysia in the forefront of the global stage, as highly influential leaders from China and United States of America visited the country. Moreover, Budget 2026 was tabled and announced to address the cost of living, good governance, and strengthening social protection for vulnerable groups. Before we dive deeper into this chapter, readers are encouraged to revisit the Q3 2025 MOM report.

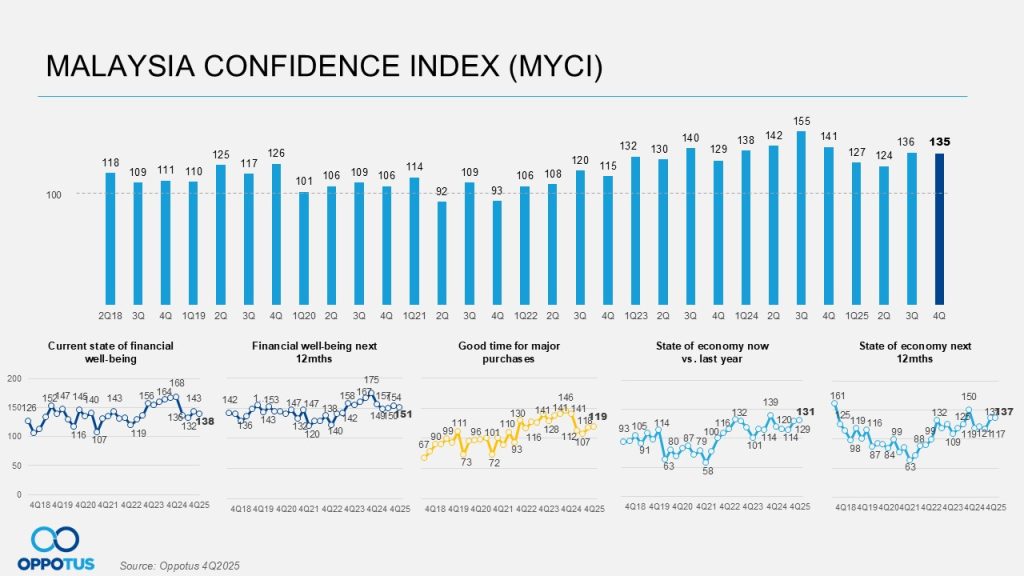

Stable MYCI Sentiments

Malayians’ confidence in Q4 held steady at 136 points, which is one point below the previous quarter. The last two quarters of 2025 have given consumers better confidence, as during the Budget 2026 announcement, to address the cost of living by providing 9 million Sumbangan Tunai Rahmah (STR) recipients to receive Sumbangan Asas Rahmah (Sara) assistance up to RM100 per month, or RM1,200 per year. Moreover, East Malaysia is expected to see an increase in development as there is up to RM6.9 billion allocated to improve the quality of life.

Continuous Positive Economic Outlook

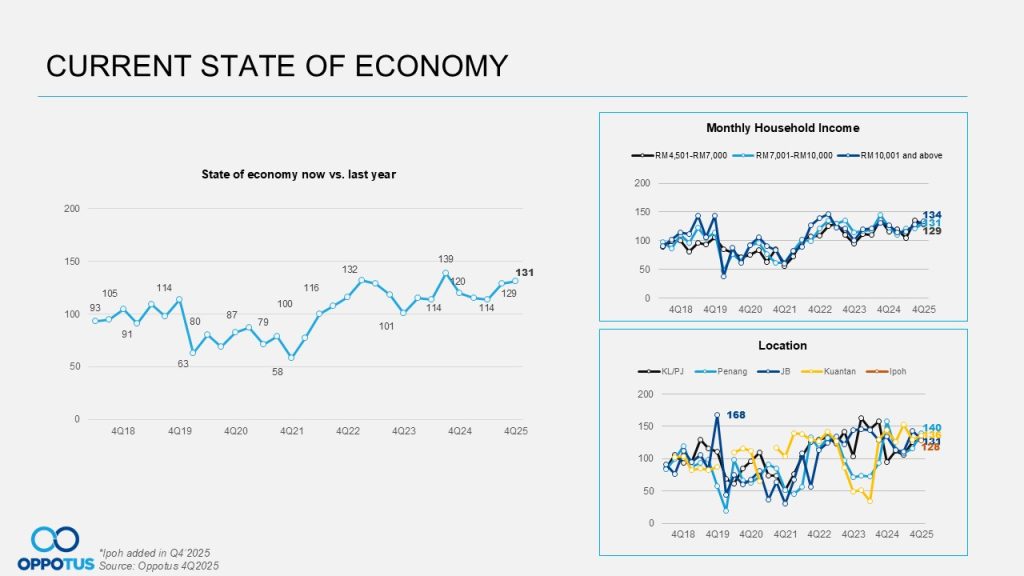

Positive economic growth continues in quarter four with an optimistic 131 points compared to quarter three at 129 points. This mirrors Malaysia’s advance estimate GDP from the Department of Statistics Malaysia (DOSM), as it is expected to grow at 5.7% in Q4 2025, up from 5.2% in Q3 2025. The rise was driven by key sectors including services, manufacturing and construction due to the demand growing hand-in-hand. The final fourth quarter 2025 GDP figure is expected to be released in February 2026.

If you are eager to dive deeper into these numbers and gain a more nuanced understanding of the forces shaping the future of business and finances, reach out to us at theteam@oppotus.com. You can also hop onto our alternative service, Oppotus DoubleDecker, an Omnibus solution to gain a first-hand preview of our next Malaysians on Malaysia (MOM) report.

The positive outlook of Malaysian Consumer Confidence Index (MYCI) in Q3 2025 extends to Q4 2025 by scoring a stable 135 points, though it is only one point lower than the previous quarter — it is still projecting a stable outlook.

There were a few key events that happened during the last quarter, especially the Budget 2026, which has had a good impact on consumers and businesses. One of the key takeaways from the announcement was the aid, social welfare and cost of living measures — consumers are expected to receive Sumbangan Asas Rahmah (Sara) assistance up to RM100 per month, or RM1,200 per year. While one million Sumbangan Tuani Rahmah (STR) recipients under the e-Kasih programme will also receive up to RM200 per month, or RM2,400 annually, under Sara. In conjunction with Deepavali, which was celebrated in October 2025, STR Phase 4 payments were advanced to October as originally scheduled for November.

Aside from the Budget 2026 announcement, the 47th ASEAN Summit was held in Malaysia in the same month. During this historical event, Malaysia was placed at the forefront of the global stage, giving consumers and investors much confidence.

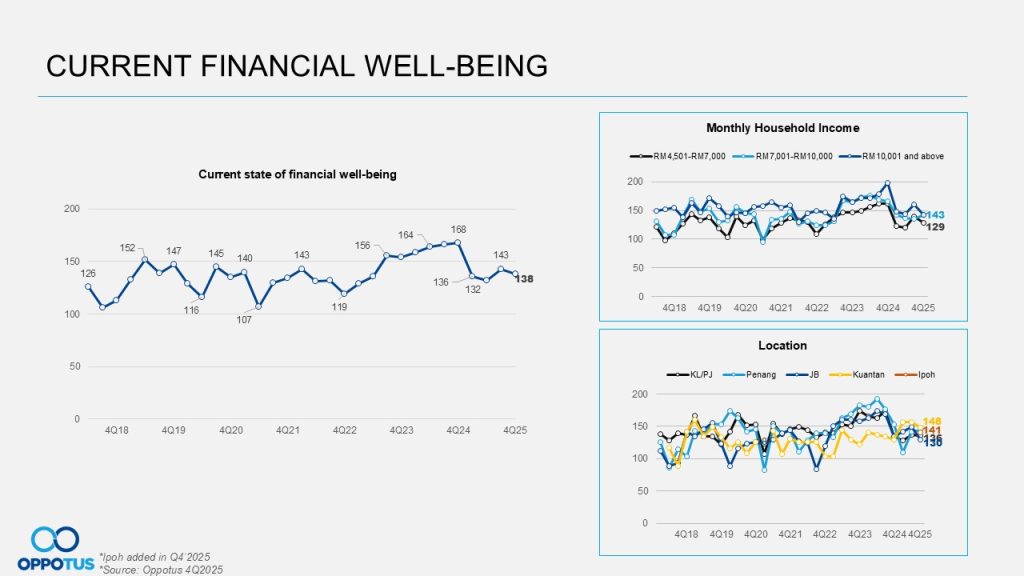

Despite the perceived optimism, sentiments of Malaysians’ financial well-being, the sentiment fell to 138 points. It is a dip from the previous quarter by 3.5%, which is likely contributed to by the inflation. This marginal dip is impacting the lower M40 group more starkly.

The impact on Johor is also reflected in a recent DOSM’s report, mentioning that in December 2025, Johor is leading the inflation rate at 2.3% amongst the five states that are impacted by an above average inflation. As a whole, Malaysia’s December 2025 inflation rose to 1.6% year-on-year, driven mainly by higher prices for personal care items, education, and selected household-related costs. Based on DOSM, the inflation for the year 2025 is averaged at 1.4%, easing from 1.8% in 2024. Moreover, this slow pace was mainly due to more moderate increases in housing-related costs, transport and health, alongside information and communication.

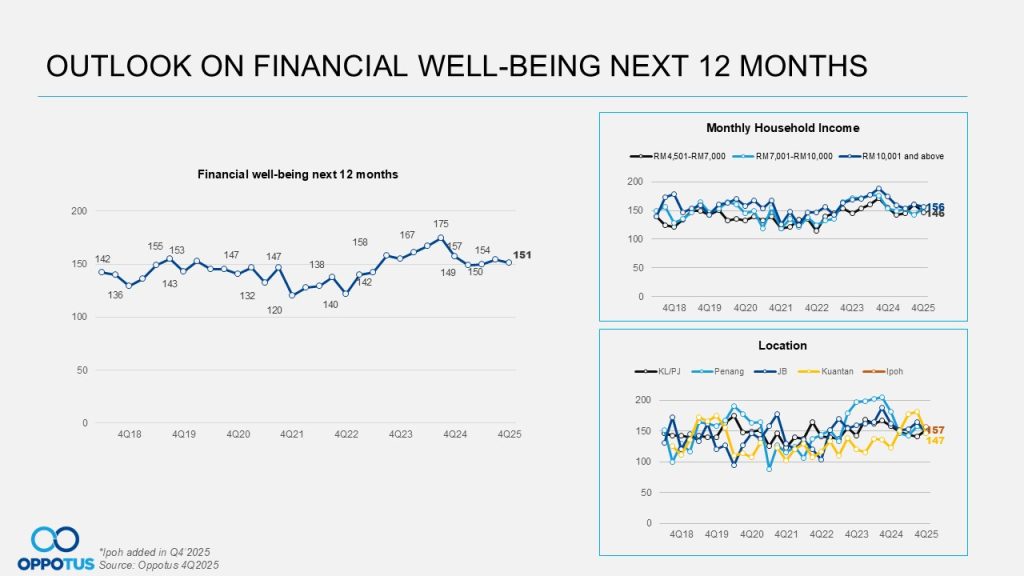

The dip in financial well-being has also impacted the outlook for the next 12 months, as it also saw a 3 point drop from 154 to 151. Looking at the big picture of the Year 2025, the average of the financial outlook for the next 12 months is at a steady and healthy 151 points, a score that continues to show that Malaysians remain hopeful quarter-on-quarter.

During Q4 2025, the government announced the second round of RM100 Sara payout to all Malaysians aged 18 and above, expected to receive in February 2026, to assist Malaysians to prepare for the Ramadan month and Chinese New Year celebrations.

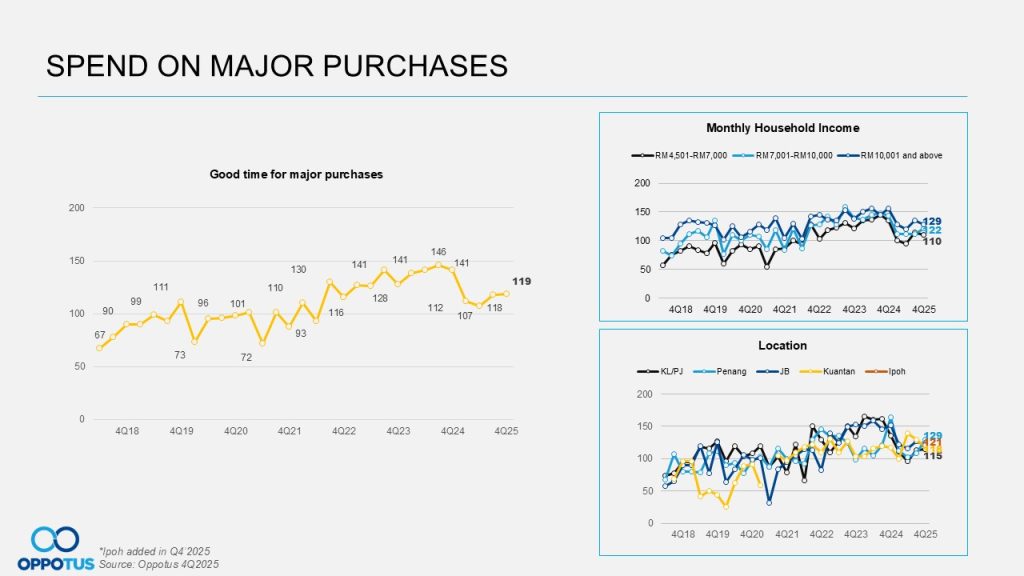

Despite the dip in financial well-being, consumer confidence towards making major purchases is holding steady, scoring 119 points vs 118 points in Q3 2025. This uplift could be from the known Double Day sales in the e-commerce market, and it’s a holiday season in the last month of the quarter.

11.11 sales were one of the biggest yet amongst the e-commerce giants (Shopee, TikTok Shop, Lazada) — each of the platforms vied for attention differently, such as TikTok Shop holding a massive LIVE Showdown and bringing over 5 million Malaysians tuning in to connect, and garnered an impressive result by generating approximately 80,000 livestream orders. While Shopee 11.11 achieved up to 14 times more orders during its Big Sales, with 1.3 billion views for both Shopee live and Shopee Video.

The current state of the economy continues to grow, resulting in 131 points, which is reflected in the expected GDP result shared by DOSM. Q4 is expected to grow at 5.7% from 5.2% the previous quarter. This is the fastest pace of economic growth in more than a year. According to DOSM, the rise was driven by key sectors including services, manufacturing and construction, with the support of the continued strengthening of domestic demand.

In addition to the latter, Ringgit Malaysia was the star performer in Asia, as it had strengthened more than 9% against the greenback year-to-date (YTD) and even greater 10.1% against the Japanese yen. The outperformance of Ringgit has been attributed to many factors, among them is the political stability and the resilience of domestic demand, including reduction of deficits, as the economy continues to grow at a modest pace.

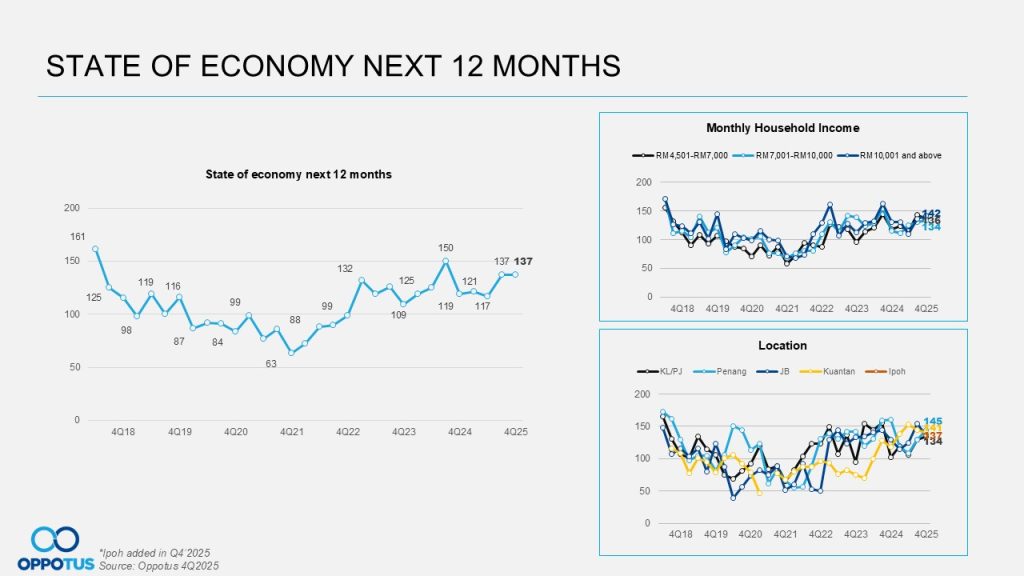

Therefore, positivity continues for economic growth over the next 12 months, with the same expectation of 137 points in both Q3 and Q4 2025. Confidence for the next 12 months was impacted by a few key factors as the economy is growing with a stronger Ringgit, GDP and moderate headline inflation.

Hence, Bank Negara Malaysia (BNM) announced in November 2025 to maintain the Overnight Policy Rate (OPR) at 2.75% at its last monetary policy committee meeting for the year. Continuous expansion in global growth remains supported by resilient labour market conditions, moderating inflation, less restrictive monetary policy and supportive fiscal policy. The conclusion of more trade negotiations has, to some extent, eased global uncertainty.

Oppotus stays committed to acquiring insights through continual analysis, offering a unique perspective on the country’s trends and consumer landscape.

Note that the opinions presented regarding Malaysia and its people reflect the views of Malaysian citizens aged 18 and above, from all income segments, residing in key cities of the Peninsular, and selected in a representative manner.

For a more granular analysis of the data above, contact us at theteam@oppotus.com. Our team of experts would be pleased to facilitate a comprehensive review and offer customised recommendations tailored to your needs. Alternatively, explore the omnibus solution to incorporate additional measures for your business through our MOM study.